gamedevmeet.ru

Gainers & Losers

Plaid Cash App

The financial institution is supported on Plaid, but the integration isn't compatible with your app. Different apps require particular Plaid products and. Campus guests with a valid guest account (e.g., OSHER students) can purchase a PlaidCash card for printing. Purchase Additional Print Quota. Summary: Cash App uses Lincoln Savings Bank as its main connection to Plaid. This allows Cash App to securely share your financial data with. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here Use of the Mobile Deposit feature requires a supported camera-equipped device and. Connect Relay to Plaid and Yodlee's expansive app network. Share account and Open up to 20 individual checking accounts to organize cash and expenses. To add a bank to your Cash App: Tap the Profile Icon on your Cash App home screen; Select Linked Banks; Tap Link Bank; Follow the prompts alt text. Cash App uses Lincoln Savings Bank as its main bank to connect with Plaid. Plaid is a financial technology company that provides APIs that allow. Plaid Inc., that your personal and financial information will be collected, processed, transferred, or stored in accordance with Plaid Inc.'s Privacy Policy. If you are having trouble linking your bank account to your Cash App: Tap the Money tab on your Cash App home screen; Press Cash Out and choose an amount. The financial institution is supported on Plaid, but the integration isn't compatible with your app. Different apps require particular Plaid products and. Campus guests with a valid guest account (e.g., OSHER students) can purchase a PlaidCash card for printing. Purchase Additional Print Quota. Summary: Cash App uses Lincoln Savings Bank as its main connection to Plaid. This allows Cash App to securely share your financial data with. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here Use of the Mobile Deposit feature requires a supported camera-equipped device and. Connect Relay to Plaid and Yodlee's expansive app network. Share account and Open up to 20 individual checking accounts to organize cash and expenses. To add a bank to your Cash App: Tap the Profile Icon on your Cash App home screen; Select Linked Banks; Tap Link Bank; Follow the prompts alt text. Cash App uses Lincoln Savings Bank as its main bank to connect with Plaid. Plaid is a financial technology company that provides APIs that allow. Plaid Inc., that your personal and financial information will be collected, processed, transferred, or stored in accordance with Plaid Inc.'s Privacy Policy. If you are having trouble linking your bank account to your Cash App: Tap the Money tab on your Cash App home screen; Press Cash Out and choose an amount.

But is Plaid safe? Yes, it's considered safe to use. That's because it employs advanced security and encryption protocols to protect your data during. While a majority of cash advance apps use Plaid, there are some that don't use Plaid. Apps like Cash App or MoneyLion offer the option to use. Plaid to have it added. Requesting support for your bank. To request support on the mobile app, please type in your bank's name in the search bar on the. Cons. There are limits to how often you can take a Vola cash advance each year; Because it uses Plaid, not all customers will qualify. Fees & APR. There is no. Plaid is free for everyone who uses a Plaid-powered app, allowing you to securely connect your bank account to the apps you want in just a few seconds. Payments: WorldRemit, Venmo, Cash App, and Metal; Lending: SoFi, Petal, Avant, and Figure. These are just a few examples, and the list of apps integrating. Withdrawals to your bank account from your Cash App appear on your statement with the prefix Cash App. M posts. Discover videos related to How to Log My Cash App Bank with Plaid on TikTok. See more videos about How to Deposit Money to Bank from Cash App. These services include: P2P applications like Cash App™ or PayPal™; Depositing funds from Current into another bank; Linking Current to Cash. You can link and edit your bank account from your Square Dashboard or the Square Point of Sale app. Linking via Plaid is available on the Square Dashboard only. Cash App and Plaid can be used together. When logging into a Plaid-powered financial services app, you can use Plaid to add your Cash App account details. You can manually enter your bank account information into the Prepaid2Cash app or select Connect Bank Account to use Plaid to enter your bank credentials. Plaid's technology provides connections to more than US banks and credit unions. Learn how we power the apps in your financial life. Pros and Cons I have found Plaid to be an outstanding platform overall, and it has considerably improved my ability to manage my finances. Lagging, crashing. How to connect and verify Cash App on Plaid? · Open the Plaid app and tap the 'Cash App' icon. · Enter your Cash App login credentials and tap 'Login'. · Plaid. Lincoln Savings Bank Cash App uses Lincoln Savings Bank as its partner bank for connecting with Plaid. This means when you link your Cash. Plaid seamlessly works with over 10, banking institutions across the US. We are NOT a payday loan, cash loan, or personal loan app, nor an app to borrow. Plaid provides third-party bank account authentication services for several well-known payment apps, such as Venmo, Coinbase, Square's Cash App, and Stripe. To apply for Atlas we need to be able to securely connect to your bank account. We do this by using Plaid, which is a trusted third party for linking to. We use Plaid to connect your external bank to your One Cash account to securely and easily transfer funds at your convenience. Adding a bank to the One app.

Top Quote Life Insurance

Top Quote Life Insurance is an independent life insurance agency that offers instant online life insurance quotes from multiple companies. With permanent life insurance, a portion of your premium may build cash value that earns interest. This extra benefit provides you financial options while you'. Shop term life insurance quotes from top carriers with SelectQuote. Click or call to buy cheap life insurance for as low as $9/month*. Find the right Life Insurance policy by comparing live quotes across a range of different policy types from the most reputable providers. What is the best life insurance for me? · Term life insurance details. No medical exam, just answer a few health questions; Apply online in minutes · Whole life. Protective, Pacific Life, Equitable and Corebridge have the best senior life insurance, according to our analysis of cash value and term life insurance policies. TopQuote is a UK-based life insurance broker for Legal & General that provides protection policies that are secure and trusted. Top Quote Life Insurance was created to provide online users with a quick and easy access to accurate affordable term life insurance quotes. Compare rates from top life insurance providers and save up to 58% on your life insurance. Instant Quotes. Compare life insurance quotes within 1 minute with. Top Quote Life Insurance is an independent life insurance agency that offers instant online life insurance quotes from multiple companies. With permanent life insurance, a portion of your premium may build cash value that earns interest. This extra benefit provides you financial options while you'. Shop term life insurance quotes from top carriers with SelectQuote. Click or call to buy cheap life insurance for as low as $9/month*. Find the right Life Insurance policy by comparing live quotes across a range of different policy types from the most reputable providers. What is the best life insurance for me? · Term life insurance details. No medical exam, just answer a few health questions; Apply online in minutes · Whole life. Protective, Pacific Life, Equitable and Corebridge have the best senior life insurance, according to our analysis of cash value and term life insurance policies. TopQuote is a UK-based life insurance broker for Legal & General that provides protection policies that are secure and trusted. Top Quote Life Insurance was created to provide online users with a quick and easy access to accurate affordable term life insurance quotes. Compare rates from top life insurance providers and save up to 58% on your life insurance. Instant Quotes. Compare life insurance quotes within 1 minute with.

Lowest Possible Rates for Life Insurance Guaranteed. We do not charge you one penny extra for our instant life insurance online quote service. And you cannot. Find the right Life Insurance policy by comparing live quotes across a range of different policy types from the most reputable providers. Talk with an insurance professional to discover the right life insurance plans and quotes for your coverage needs. Get a fast, free term life insurance quote online from Protective Life top life insurance companies. Protective is not only our name, it's our. Our guide to life insurance quotes allows you to compare quotes online and gives you the information to understand what affects a life insurance quote. Compare Rates of Life Insurance Companies in 5 Seconds. View Instant Quotes. select quote Life Insurance companies · American General – A.M. Best Rating: A · Banner Life – A.M. Best Rating: A+ · Globe Life – A.M. Best Rating: A · Mutual of. Easily find the best instant term life insurance quotes tailored to your needs with gamedevmeet.ru's secure online platform. No contact information. A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them. Get a free quote today. Life insurance is a contract in which you pay premiums, and in return your beneficiary receives a lump-sum payout when you die. Quotacy helps you choose the right life insurance policies. We check other top-rated life insurance companies to make sure you get the best price. Find affordable life insurance policies and get a personalized life insurance quote in minutes. Learn about term life, final expense, and whole life and. As independent brokers, we work for you - not the insurance companies. That means you get a wide choice of policies from top-rated carriers at the best. What is the best life insurance for me? · Term life insurance details. No medical exam, just answer a few health questions; Apply online in minutes · Whole life. Best Prices and Professional! Louis J. Highly Recommend Best Quote! Natalie provides honest and transparent guidance to insurance. I don't hesitate. Compare Rates of Life Insurance Companies in 5 Seconds. View Instant Quotes. Term life insurance protects those you love should something happen. Compare term life insurance quotes and find your best price with Quotacy. Quotacy helps you choose the right life insurance policies. We check other top-rated life insurance companies to make sure you get the best price. Policygenius provides free quotes tailored to your needs with support from licensed agents, helping you get insurance coverage fast so you can get on with life. The most popular permanent policy, whole life provides coverage for your entire life at a fixed premium. Plus, it builds cash value at a fixed rate over time.

A2z Movers

Our movers have many years of experience in loading and unloading trucks, trailers, pods and ensure that your items are moved and loaded with the utmost care. Vonn W. Moving From Avondale, AZ to Goodyear, AZ · 3 Bedroom. Communication: 5/5Professionalism: 5/. One of my better decisions was to hire A2Z. They were professional, careful with my things and completed the move much faster than I anticipated. Looking for movers in San Tan Valley, Arizona? Trust A to Z Valley Wide Movers for professional moving services. Read reviews and book your move online! Vonn W. Moving From Avondale, AZ to Goodyear, AZ · 3 Bedroom. Communication: 5/5Professionalism: 5/. This organization is not BBB accredited. Movers in Flemington, NJ. See BBB rating, reviews, complaints, & more. A2Z Movers. Based out of Yelm, WA. About Us. We strive to be professional helpers to move your belongings. We are hardworking, honest, and dependable. To learn more about the moving contractors at A to Z Moving & Storage in West Springfield, MA, call () In Business For 25+ Years! A to Z Express Moving & Storage has provided expert residential and commercial moving, packing and storage services since Our movers have many years of experience in loading and unloading trucks, trailers, pods and ensure that your items are moved and loaded with the utmost care. Vonn W. Moving From Avondale, AZ to Goodyear, AZ · 3 Bedroom. Communication: 5/5Professionalism: 5/. One of my better decisions was to hire A2Z. They were professional, careful with my things and completed the move much faster than I anticipated. Looking for movers in San Tan Valley, Arizona? Trust A to Z Valley Wide Movers for professional moving services. Read reviews and book your move online! Vonn W. Moving From Avondale, AZ to Goodyear, AZ · 3 Bedroom. Communication: 5/5Professionalism: 5/. This organization is not BBB accredited. Movers in Flemington, NJ. See BBB rating, reviews, complaints, & more. A2Z Movers. Based out of Yelm, WA. About Us. We strive to be professional helpers to move your belongings. We are hardworking, honest, and dependable. To learn more about the moving contractors at A to Z Moving & Storage in West Springfield, MA, call () In Business For 25+ Years! A to Z Express Moving & Storage has provided expert residential and commercial moving, packing and storage services since

Zero Stress. We provide consistent and unmatchable moving experience throughout different states. Our primary focus is to make “Your Move Stress-free”. A2Z Movers Hoboken | () | Hoboken Moving Company | Residential and commercial movers of New Jersey. One of the most reputable moving companies. Looking for movers in San Tan Valley, Arizona? Trust A to Z Valley Wide Movers for professional moving services. Read reviews and book your move online! A to Z Moving and Driving LLC (Licensed and Insured). Movers for all your moving needs: loading, unloading, packing, unpacking, cleaning, junk removal. We serve the Chicagoland area by offering professional moving services. Movers, Carrying, Shelving Unit, Residential Moving Services. A to Z Valleywide Movers is proud to serve Ahwatukee in the areas of , , and We offer affordable pricing for all of your local and long. Get more information for A2Z Movers New York in New York, NY. See reviews, map, get the address, and find directions. Our long-distance moving services will take you from A to Z, stress-free. Contact us at () or visit gamedevmeet.ru for a seamless move. Get information, directions, products, services, phone numbers, and reviews on A2Z Movers in Atlanta, undefined Discover more Local Trucking with Storage. About A to Z Moving & Storage, Inc. Located in Springfield, MA, A to Z Moving & Storage is a family-owned and operated specialized moving service serving. We are A2Z Moving LLC - one of the top-rated Chicago movers. Our crews experienced, reliable, and affordable. We'd love to make your move into. Specialties: A2z Moving & Delivery specializes in local and long distance moving. Our company is made up of movers with years of experience in the moving. A to Z Valley Wide Movers is based in Gilbert, Arizona. We are a dedicated moving company that strives to make your move easy and painless. here you'll find all the moving reviews, ratings, complaints, and customer testimonials you'll ever need for A To Z Movers, West Springfield MA. Get more information for A2z Movers LLC in Atlanta, GA. See reviews, map, get the address, and find directions. Our team of experienced movers knows Michigan like the back of our hands. From the bustling cities to the charming small towns, we'll get you from A to Z with. Hire local moving helpers in Avondale, AZ. Get the best local packing, loading, and unloading that Avondale has to offer at Moving Help®. A to Z Moving and Driving LLC (Licensed and Insured). Movers for all your moving needs: loading, unloading, packing, unpacking, cleaning, junk removal. A2Z moving llc provides Local Moving (under 50 miles), Demolition Services, Pool Table Moving, Piano Moving services. See their reviews & get quotes today. Our Moving Company in Baltimore, MD. A to Z Movers is a family-owned and operated moving services company with experienced, professional Baltimore movers. We.

Zelle Max Transfer Chase

How much money can I transfer? Most Chase accounts have a $25, per day limit. Chase Private Client and Chase Sapphire Banking limits are $, per day. The intention of Zelle is for sending money to an account at an outside financial institution and has daily and monthly sending limits. Member-to-Member. If you're not using a bank or credit union, you can transfer up to USD per week via the Zelle app. You can also receive up to 5, USD per week from other. Tap "Transfer" and then choose "Account or Brokerage Transfer"; Step three Zelle. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and. Chase Bank; Chelsea State Bank; Chemung Canal/Capital Bank; Chesapeake Bank; Chesapeake Bank Trust; Chevron Federal Credit Union; CHHE FCU; Chino Commercial. Zelle transfer limits vary from bank to bank, however, if you bank with Chase, you can send up to $10, a day with Zelle. You can check your personal. Zelle Pay Limits at Top Banks - Full List of Banks That Integrate With Zelle ; Chase. For Chase Personal Checking and Chase Liquid cards: up to $2,/day; For. Are there any limits to how much and how often I can send money with Zelle®? Chase QuickPay® with Zelle® is now just Zelle Send and receive money in moments 1 so no more waiting days or paying fees like other apps. How much money can I transfer? Most Chase accounts have a $25, per day limit. Chase Private Client and Chase Sapphire Banking limits are $, per day. The intention of Zelle is for sending money to an account at an outside financial institution and has daily and monthly sending limits. Member-to-Member. If you're not using a bank or credit union, you can transfer up to USD per week via the Zelle app. You can also receive up to 5, USD per week from other. Tap "Transfer" and then choose "Account or Brokerage Transfer"; Step three Zelle. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and. Chase Bank; Chelsea State Bank; Chemung Canal/Capital Bank; Chesapeake Bank; Chesapeake Bank Trust; Chevron Federal Credit Union; CHHE FCU; Chino Commercial. Zelle transfer limits vary from bank to bank, however, if you bank with Chase, you can send up to $10, a day with Zelle. You can check your personal. Zelle Pay Limits at Top Banks - Full List of Banks That Integrate With Zelle ; Chase. For Chase Personal Checking and Chase Liquid cards: up to $2,/day; For. Are there any limits to how much and how often I can send money with Zelle®? Chase QuickPay® with Zelle® is now just Zelle Send and receive money in moments 1 so no more waiting days or paying fees like other apps.

Step one Sign in to gamedevmeet.ru and click "Pay & Transfer" · Step two Click on "Transfer Money" · Step three You can also add an external account by clicking on Pay. Note 1 Funds transfer applies to U.S. accounts only. Zelle® and the Zelle® related marks are wholly owned by Early Warning. It's Fast. With Zelle®, money typically arrives within minutes between enrolled users—wherever they bank in the U.S. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Sign in to the Chase Mobile® app and tap "Pay and Transfer" · Tap "Send Money with Zelle®" · Tap "Get started" (you may need to agree to terms and conditions). make Real-Time Payments (RTP®) transactions up to the value of $2, per transaction and $5, daily (subject to change). When will my transfer be processed? Chase QuickPay is Chase's name for its easy money-transfer feature, and Zelle is the service that makes it work. Also, Zelle works with most U.S. banks, so. Standard fee: Chase does not charge additional fees for Zelle® transactions. To use Zelle®, Chase customers must use an eligible Chase checking account, which. Step 4. Start sending and receiving money! Notification of a completed digital payment transfer using Zelle on the Fifth Third Bank mobile app. Zelle is available in your Key mobile banking app so you can pay for services and send money to friends quickly and easily. Learn more today. Open the Chase Mobile® app and click "pay and transfer." Tap "Send money with Zelle®." Select your trusted recipient or add a new one. Key in the amount to send. Use Zelle to get paid or send payments in moments. It's free to Chase customers and available 24/7 on your Chase Mobile® app or gamedevmeet.ru Enrollment in Zelle® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business. Neither J.P. Morgan Chase nor Zelle® offers reimbursement for authorized payments you make using Zelle®, except for a limited reimbursement program that applies. The maximum wire amount depends on the available funds in your account Zelle and the Zelle related marks are wholly owned by Early Warning Services. The maximum amount you can send per transfer is $5, What fees and commissions does Chase zelle charge? Chase zelle does not charge a flat processing fee. Then, to send money: Log in to the mobile app or Online Banking and find Pay & Transfer; Choose Zelle® and select Pay; Choose who you want to pay from your. maximum returns on your money. Learn about MarketRate Checking Open the Mobile Banking* app, tap "Transfer and Pay," then "Send Money with Zelle®. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Payment limit: $2, in a rolling 24 hours. Learn more about Zelle®. Recurring ACH Transfers. $0 fee.

Medical Debt Removed From Credit Report

Paid medical debts may be removed from your credit history or simply disregarded when calculating your credit score. The bottom line. Medical events and medical. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. 1 After all, the complex world of. These joint measures will remove nearly 70% of medical collection debt tradelines from consumer credit reports, a step taken after months of industry research. Wall Street Journal, Anna Maria Andriotis. Equifax, Experian and TransUnion are making sweeping changes to how they report medical debt in collections. The credit-reporting firms have been speaking with banks to get their take on removing medical debts, according to people familiar with the matter. Some banks. Medical debt collection occurs when an overdue medical bill is sent to a debt collection agency. Though there are ways to deal with the situation, the stress. As of January , VantageScore will no longer use medical debt or medical collection information in the calculation of VantageScore credit scores. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. 1 After all, the complex world of. A bill to amend the Fair Credit Reporting Act to institute a 1-year waiting period before medical debt will be reported on a consumer's credit report. Paid medical debts may be removed from your credit history or simply disregarded when calculating your credit score. The bottom line. Medical events and medical. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. 1 After all, the complex world of. These joint measures will remove nearly 70% of medical collection debt tradelines from consumer credit reports, a step taken after months of industry research. Wall Street Journal, Anna Maria Andriotis. Equifax, Experian and TransUnion are making sweeping changes to how they report medical debt in collections. The credit-reporting firms have been speaking with banks to get their take on removing medical debts, according to people familiar with the matter. Some banks. Medical debt collection occurs when an overdue medical bill is sent to a debt collection agency. Though there are ways to deal with the situation, the stress. As of January , VantageScore will no longer use medical debt or medical collection information in the calculation of VantageScore credit scores. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. 1 After all, the complex world of. A bill to amend the Fair Credit Reporting Act to institute a 1-year waiting period before medical debt will be reported on a consumer's credit report.

Three of the nation's largest credit bureaus - Experian, Equifax, and Transunion - announced they will be removing nearly 70% of medical debt from consumer. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. After all, the complex world of medical. The following personnel may seek assistance via the Defense Health. Agency Great Lakes (DHA-GL) DCAO to resolve debt collection issues: If Member MUST . Learn more about collection accounts on your credit report and how you can get back on track. As a result, the first time medical debt shows up on consumers' credit reports is often when their debt is already in collections. Having a collection item on. Once you have paid medical debt down to nothing, the credit bureaus will remove the medical collections from your report. Credit Score Changes. When an unpaid. The law that creates this protection can be found in the Colorado Consumer Credit. Reporting Act, at Colorado Revised Statutes (1)(f)(I). Good news! To have medical collections deleted from your credit report. you should follow the same steps I used by seeking help from Nelson Gutierrez. Two of the three changes to medical debt credit reporting practices imposed by the national credit reporting agencies (CRAs)—Equifax, Experian and. It's no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt. After all, the complex world of medical. A consumer reporting agency is prohibited from including on a consumer credit report, and a person is prohibited from reporting to such agency (1) medical debt. It requires that a consumer reporting agency remove medical debt on a consumer's consumer report once the credit reporting agency receives information that the. The Nationwide Credit Reporting Agencies (NCRAs) — Equifax®, Experian® and TransUnion® — removed medical collection debt with an initial reported balance of. summaryThis amendment is the majority report of the committee. The amendment does the gamedevmeet.ru prohibits a consumer reporting agency from reporting debt. If the bill goes unpaid for many months, the medical provider may sell the debt to a collections agency. Does unpaid medical debt impact your credit? Yes. Medical debts are a huge portion of the negative information in credit reports, making up about half of debt collection amounts on these reports and affecting. Key takeaways: Beginning July 1, , consumer credit-reporting agencies Equifax, Experian, and TransUnion began waiting 1 year before including unpaid medical. Chi Chi Wu has been a staff attorney at NCLC for more than a decade, with a focus on consumer credit issues, including legislative, administrative. There's a day waiting period, before the unpaid medical debt can show up on your credit report. While health insurance may help, many people still. While this is welcome news for patients, it could make the revenue cycle management (RCM) process for healthcare providers more challenging. Smaller medical.

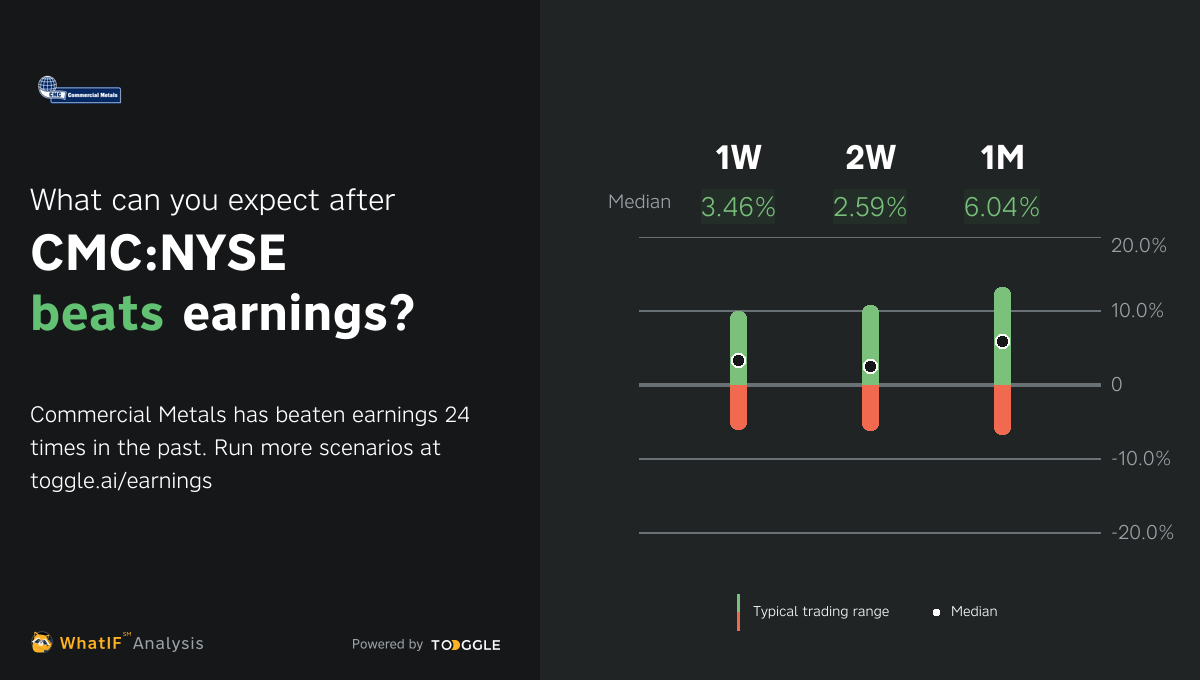

Cmc Nyse

Commercial Metals Company (NYSE:CMC): Promising Results and a Healthy Pipeline. 2M ago. CMC. Commercial Metals price target lowered to $69 from $70 at BofA. IRVING, Texas, Aug. 22, /PRNewswire/ -- Commercial Metals Company (NYSE: CMC) has earned recognition on TIME's inaugural list of America's Best Mid-Size. COMMERCIAL METALS CO CMC Market Data is delayed by 15 minutes and is for informational and/or educational purposes only. In certain circumstances, securities. Is Commercial Metals (NYSE:CMC) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. CMC stock logo. About Commercial Metals Stock (NYSE:CMC). Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and. CMC stock analysis and financial data, including key statistics and NYSE: CMC. Price (delayed). $ Market cap. $B. P/E Ratio. Dividend. Commercial Metals (NYSE: CMC). $ (%). $ Price as of August 30, Commercial Metals Co CMC:NYSE. Last Price, Today's Change, Today's Volume. $, (%), 0. As of close 08/28/ Summary; News; Charts; Ratings. The current price of CMC is USD — it has decreased by −% in the past 24 hours. Watch Commercial Metals Company stock price performance more closely on. Commercial Metals Company (NYSE:CMC): Promising Results and a Healthy Pipeline. 2M ago. CMC. Commercial Metals price target lowered to $69 from $70 at BofA. IRVING, Texas, Aug. 22, /PRNewswire/ -- Commercial Metals Company (NYSE: CMC) has earned recognition on TIME's inaugural list of America's Best Mid-Size. COMMERCIAL METALS CO CMC Market Data is delayed by 15 minutes and is for informational and/or educational purposes only. In certain circumstances, securities. Is Commercial Metals (NYSE:CMC) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. CMC stock logo. About Commercial Metals Stock (NYSE:CMC). Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and. CMC stock analysis and financial data, including key statistics and NYSE: CMC. Price (delayed). $ Market cap. $B. P/E Ratio. Dividend. Commercial Metals (NYSE: CMC). $ (%). $ Price as of August 30, Commercial Metals Co CMC:NYSE. Last Price, Today's Change, Today's Volume. $, (%), 0. As of close 08/28/ Summary; News; Charts; Ratings. The current price of CMC is USD — it has decreased by −% in the past 24 hours. Watch Commercial Metals Company stock price performance more closely on.

For valuing profitable companies with steady earnings CMC is good value based subscribe to Premium to read more. CMC is good value based subscribe to. Commercial Metals Co (NYSE:CMC) Intrinsic Valuation. Check if CMC is overvalued or undervalued under the bear, base, and bull scenarios of the company's. Invest in Commercial Metals, NYSE: CMC Stock - View real-time CMC price charts. Online commission-free investing in Commercial Metals: buy or sell. NYSE, CMC - Commercial Metals Company We manufacture, recycle, market and distribute steel and metal products and related materials and services through a. Commercial Metals Co CMC:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High Commercial Metals (CMC). (Delayed Data from NYSE). $ USD. , (%). Updated Sep 4, PM ET. After-Market: $ + ( Moody's Daily Credit Risk Score is a score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. Home CMC • NYSE. add. Share. Commercial Metals Company. $ After Hours (%) Closed: Aug 23, PM GMT-4 · USD · NYSE · Disclaimer. 1D. 5D. Webull offers CMC Ent Holdg (CMC) historical stock prices, in-depth market analysis, NYSE: CMC real-time stock quote data, in-depth charts, free CMC options. The good news is US stocks (and other international shares) can be traded as easily as domestic ones on CMC's share trading platform. Buy and sell orders can. Commercial Metals Co CMC:NYSE. Last Price, Today's Change, Today's Volume. $, (%), , Average. As of am ET 09/03/ About CMC. Facts Insights Learn. Commercial Metals Co. engages in the (NYSE:CMC): Promising Results and a Healthy Pipeline by TipRanks Jun 26 8. Sure, you'll find CMC construction solutions at the heart of much of our modern infrastructure — from AT&T Stadium in Dallas to the Pentagon to essential. Stock Market Index Fund Investor Shares, and IJH - iShares Core S&P Mid-Cap ETF. Commercial Metals Company (NYSE:CMC) institutional ownership structure. Find out trading hours for major international stock exchanges, including London and New York. Learn how to trade on stock market price movements here. Metals Co. CMC (U.S.: NYSE). search. View All companies. AT CLOSE PM EDT 09/03/ $ USD; %. Volume 1,, PRE MARKET AM EDT Commercial Metals Stock (NYSE: CMC) stock price, news, charts, stock research, profile. View the latest CMC share price or buy & sell Commercial Metals stock on NYSE using Lightyear. Commercial Metals Co operates steel mills, steel fabrication. Commercial Metals Company (NYSE: CMC) has earned recognition on TIME's inaugural list of America's Best Mid-Size Companies This prestigious award is. Find the latest Commercial Metals Company financial news and headlines to keep up with the events that impact CMC performance.

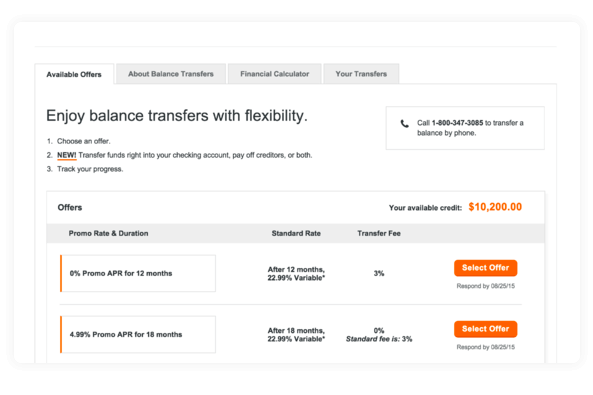

18 Month Balance Transfer Credit Card

Citi Double Cash® Card 0% Intro APR for 18 months on balance transfers; after that, the variable APR will be % - % based on your creditworthiness. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. month 0% introductory rate on balance transfers. Credit Needed. Excellent, Good, Fair Intro Bonus. Earn $ cash back after you spend $1, on. Purchases and balance transfers are interest free with 0% intro APR for 18 months from account opening, after that a variable APR of Min. of (+). Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. You might also lower your overall monthly payments and turn multiple bills into one easy payment. Balance transfer fees may apply. A balance transfer can give. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Get 0% intro APR on card balances you transfer during the first 18 months, with a 3 percent fee on each transfer, or $5, whichever is greater. After the. Balance transfer credit cards offer low introductory APRs that can help you pay your balance down faster. Citi Double Cash® Card 0% Intro APR for 18 months on balance transfers; after that, the variable APR will be % - % based on your creditworthiness. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. month 0% introductory rate on balance transfers. Credit Needed. Excellent, Good, Fair Intro Bonus. Earn $ cash back after you spend $1, on. Purchases and balance transfers are interest free with 0% intro APR for 18 months from account opening, after that a variable APR of Min. of (+). Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. You might also lower your overall monthly payments and turn multiple bills into one easy payment. Balance transfer fees may apply. A balance transfer can give. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Get 0% intro APR on card balances you transfer during the first 18 months, with a 3 percent fee on each transfer, or $5, whichever is greater. After the. Balance transfer credit cards offer low introductory APRs that can help you pay your balance down faster.

0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. New card. Balance transfer fee. New balance. $ Introductory period. 12 Months, 18 Months, 24 Months. Introductory interest rate. Standard interest rate. 0% interest on balance transfers for up to 18 months. From the date you open your account. Transfers must be made within 60 days to benefit from the 0% offer. Enjoy a low intro APR on purchases and balance transfers for 18 months from account opening.† Opens pricing and terms in new window. AT A GLANCE. Lower your. Get up to 5% cash back in your first 3 months and a % introductory interest rate on Balance Transfers for 9 months with a 2% transfer fee. Apply Now. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. So you may have almost. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. So you may have almost. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Our lowest intro APR on balance transfers and purchases Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard. Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % – %, based on your. For instance, it offers an month 0% APR, which gives you an extended term to pay down transferred balances. The card also comes with no annual fee and. There aren't any credit cards that offer a 0% APR on balance transfers for 24 months right now. However, the Citi Simplicity® Card gives the next best thing. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. Balance transfers must be completed within 4 months of account opening. There is a balance transfer fee of either $5 or 5% of the amount of each transfer. A balance transfer could help you save on interest and reduce monthly payments. You can easily move the balance from another credit card to your Navy. If you're chipping away at high-interest credit card debt, moving it to the Discover it® Cash Back - 18 Month Intro Balance Transfer Offer can get you a nice. The introductory rate may be as low as 0% and last anywhere from six to 18 months. After securing a month 0% balance transfer on a new credit card. Longest 0% APR Credit Cards for Balance Transfers of August ; Best Intro APR Balance Transfer Card With Cellphone Protection From Wells Fargo (21 months).

How Much Does A 401k Cost Per Month

This covers the cost of holding the assets, and it's about $ per month for every $10, saved. Fund fees as low as %. Averaging at about %. provides the average employer cost for wages and salaries as well as benefits per hour worked. The. ECEC covers the civilian economy, which includes data. (k) fees can range between % and 2% or even higher, based on the size of an employer's (k) plan, how many people are participating in the plan, and. SIMPLE IRAs · $25 for each Vanguard mutual fund in each account. ; (b) plans · $5 per month per Participant ($60 per year). ; Individual (k) & Individual Roth. The average age to retire is 65 for men and 63 for women, so it's not surprising to see the average and median (k) balance figures start to decline in. Pricing for individuals with a balanceFootnote 7. Monthly recordkeeping fees: $ Annual asset based costsFootnote †. cost to the employer (e.g. $3/month per participant). That can add up and How does your (k) provider keep costs in check? We automatically lower. Investment management fees These fees make up a piece of an investment's expense ratio, which is the percentage fee charged within the mutual funds you've. We set this pricing structure to keep it simple and the funds in the lineup do not charge management fees or, with limited exceptions, fund expenses. Employees. This covers the cost of holding the assets, and it's about $ per month for every $10, saved. Fund fees as low as %. Averaging at about %. provides the average employer cost for wages and salaries as well as benefits per hour worked. The. ECEC covers the civilian economy, which includes data. (k) fees can range between % and 2% or even higher, based on the size of an employer's (k) plan, how many people are participating in the plan, and. SIMPLE IRAs · $25 for each Vanguard mutual fund in each account. ; (b) plans · $5 per month per Participant ($60 per year). ; Individual (k) & Individual Roth. The average age to retire is 65 for men and 63 for women, so it's not surprising to see the average and median (k) balance figures start to decline in. Pricing for individuals with a balanceFootnote 7. Monthly recordkeeping fees: $ Annual asset based costsFootnote †. cost to the employer (e.g. $3/month per participant). That can add up and How does your (k) provider keep costs in check? We automatically lower. Investment management fees These fees make up a piece of an investment's expense ratio, which is the percentage fee charged within the mutual funds you've. We set this pricing structure to keep it simple and the funds in the lineup do not charge management fees or, with limited exceptions, fund expenses. Employees.

(k) Early Withdrawal Costs Calculator ; Early withdrawal amount ; Federal income tax rate ; State income tax rate ; Local/city income tax rate ; Are you employed? Where do you live? Your location is used to determine taxes in retirement. Do this later. Dismiss. Next. Plans start as low as $ per month + $6 per participant per month. In general, "qualified startup costs" are ordinary and necessary expenses of an. The plan may state this promised benefit as an exact dollar amount, such as $ per month at retirement. an easy, low-cost retirement plan option for. But where healthcare costs can run between $6, (for single coverage) to $18, (for family coverage) per employee per year, 1 a (k) plan cost is only a. What does it cost? Prices start at just $46/month. Join more than , businesses and their teams. Create account. Pricing. Starting at just $46 per month. Must participate in the plan within two months of being hired; Should be eligible for matching or nonelective employer contributions as if they were employed. Plans as low as $19 / mo. Transparent and affordable (k) pricing with a range of plans to fit your retirement needs. Monthly. How much do you plan to contribute per pay period while repaying the loan? Enter "0" if you do not plan to contribute while the loan is outstanding. "The lump sum in your (k) may seem like a lot, but when you translate it into a monthly income stream over 20 or 30 years, it may not be as much as you. I reviewed the plan details today and noticed the statement "All (k) participants are charged a quarterly $ recordkeeping fee", so $42/. They are often the largest component of retirement plan costs and are paid by all shareholders of the investment option. Typically, asset-based fees are. Administrative fees often run about $ to $ per participant per year. These fees may or may not be disclosed. Employers sometimes pay these fees, said. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. how much more you could have for retirement. Try entering different Twice a month (24 paychecks per year); Monthly (12 paychecks per year); Annually. $ monthly base fee, billed each calendar year annually ($1,) · +$5. monthly record-keeping fee per participant · +%. annual advisory fee. $5, to $10, a year; Initial start-up fee $ - $3,; Quarterly per participant charges $15 - $40; Administrative fees - $ - $1, a year. Small. With Fidelity, you have no account fees and no minimums to open an account.1 You'll get exceptional service as well as guidance from our team. Open a self-. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your (k) plan. But how do you know if setting up a retirement savings plan will fit into your organization's budget? The calculator below can help you quickly estimate how.

How To Find Amount Financed On A Car

Monthly car payments are typically calculated based on the total amount financed, the interest rate, and the length of the loan. We use your amount financed, APR and the length of your contract to calculate your monthly payment. Your next vehicle is waiting for you. Find a dealer and get. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Interest Rate (APR). Interest Rate (APR). Do you know your loan amount? Yes No. Loan Amount. Loan Amount. Car Price. Car Price. Down Payment. Down Payment. Your outstanding principal balance is multiplied by the daily interest rate (your interest rate divided by ) to calculate your interest payment. Essentially. PMT = loan payment; PV = present value (loan amount); i = period interest rate expressed as a decimal; n = number of payments. To calculate auto loan payments, start by finding the monthly interest rate by dividing the annual interest rate by It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the. Look for a row of information about the annual percentage rate, finance charge, amount financed, total of payments, and total sale price. Monthly car payments are typically calculated based on the total amount financed, the interest rate, and the length of the loan. We use your amount financed, APR and the length of your contract to calculate your monthly payment. Your next vehicle is waiting for you. Find a dealer and get. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Interest Rate (APR). Interest Rate (APR). Do you know your loan amount? Yes No. Loan Amount. Loan Amount. Car Price. Car Price. Down Payment. Down Payment. Your outstanding principal balance is multiplied by the daily interest rate (your interest rate divided by ) to calculate your interest payment. Essentially. PMT = loan payment; PV = present value (loan amount); i = period interest rate expressed as a decimal; n = number of payments. To calculate auto loan payments, start by finding the monthly interest rate by dividing the annual interest rate by It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the. Look for a row of information about the annual percentage rate, finance charge, amount financed, total of payments, and total sale price.

Enter an amount to finance. Calculate. Car image. After you've entered your Find the right auto financing for you. Finance new or used vehicles. You. Loan amount is based on the net purchase price of the vehicle (plus sales tax) or the vehicle price less any cash rebate, trade-in or down payment. If you have. Calculate my payment; I would like to Calculate my maximum loan amount. More information - Price of your new Price of your new vehicle. close. We use the vehicle's price, including taxes, to determine how much you may be able to borrow and your monthly payments. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other. Calculate your monthly payment and view a full amortization schedule for a 6-year (72 month) car loan. Loan Amount: $. Annual Interest Rate (%): %. This differs from your loan amount. To help you figure out how much you can spend on your vehicle purchase, our experts recommend that your monthly auto loan. Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. It'll also help you figure out how much. Estimate the monthly car payments of your next vehicle. Enter details about your down payment, cost of car and more to see how these factors affect your. Multiply that by 1, and you get your answer: $8, is the maximum amount you can finance. If you extend the loan out to 60 months, the maximum amount you. This calculator can help you determine how much your monthly vehicle payments may be. Loan amount, loan term, and interest rate all factor into the calculation. Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your. The amount financed may be lower than the amount you applied for because it represents a net figure: it's equal to your loan amount minus any prepaid fees. Does. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. The amount financed may be lower than the amount you applied for because it represents a net figure: it's equal to your loan amount minus any prepaid fees. Does. The second calculator helps you figure out what vehicle price you can afford for a given monthly loan payment. Calculator Budget Rates. Auto Loan Basics, Amount. How to use the formula for APR calculation · Calculate the interest rate. · Add the administrative fees to the interest amount. · Divide by the loan amount . The first step is to choose whether you know the price of the car and want to figure out the monthly payments, or if you know how much you can afford each month. Use this calculator to help you determine your monthly car loan payment or your car purchase price. Use online appraisal sites to determine your current vehicle's trade-in value, then subtract this amount and your down payment from the vehicle purchase price.

Spy Average True Range

before getting into it, let's define what average true range (ATR) is. Very simply, ATR is how much a stock will move on any given day - it's. ATR Trailing Stops are commonly used by trend traders to set stop-loss levels that move alongside the trend. Awesome Oscillator. The Awesome Oscillator is a. The average true range is an indicator of the price volatility of an asset. It is best used to determine how much an investment's price has been moving in the. Stands for Average True Range. It is a volatility indicator which indicates the degree of price volatility at an absolute level compared with its 9 SMA. Time. Analyze current daily levels of Average True Range indicator for SPDR S&P ETF. Technicals are widely used by investors to gauge performance, momentum etc. The AverageTrueRange indicator is a measure of volatility introduced by Welles Wilder in his book: New Concepts in Technical Tr. Average True Range (ATR) is the average of true ranges over the specified period. ATR measures volatility, taking into account any gaps in the price movement. Current Technical Analysis and interactive chart for $SPY stock / shares. See Average True Range, RSI (14), ADX, +DI, -DI, The Average True Range measured over 14 days. The Average True Range measured over 20 days, expressed as a percentage. The Recent Average True Range (2 days). before getting into it, let's define what average true range (ATR) is. Very simply, ATR is how much a stock will move on any given day - it's. ATR Trailing Stops are commonly used by trend traders to set stop-loss levels that move alongside the trend. Awesome Oscillator. The Awesome Oscillator is a. The average true range is an indicator of the price volatility of an asset. It is best used to determine how much an investment's price has been moving in the. Stands for Average True Range. It is a volatility indicator which indicates the degree of price volatility at an absolute level compared with its 9 SMA. Time. Analyze current daily levels of Average True Range indicator for SPDR S&P ETF. Technicals are widely used by investors to gauge performance, momentum etc. The AverageTrueRange indicator is a measure of volatility introduced by Welles Wilder in his book: New Concepts in Technical Tr. Average True Range (ATR) is the average of true ranges over the specified period. ATR measures volatility, taking into account any gaps in the price movement. Current Technical Analysis and interactive chart for $SPY stock / shares. See Average True Range, RSI (14), ADX, +DI, -DI, The Average True Range measured over 14 days. The Average True Range measured over 20 days, expressed as a percentage. The Recent Average True Range (2 days).

· Chart Range · Frequency · Display · Indicators · Compare.

Technical Indicators ; ATR(14), , Less Volatility ; Highs/Lows(14), 0, Neutral. The average true range (ATR) is a technical indicator that is used within the financial markets to measure volatility. It analyses a range of asset prices. Create advanced interactive price charts for SPY, with a wide variety of Avg True Range (ATR), Bollinger Band Width, Bollinger %B, Commodity Channel. Traditional uses the constant Brick Size, where ATR values result in fluctuating brick sizes. Period (14) - the period used to calculate the ATR. Source (Close). The Average True Range was developed by J. Welles Wilder in s. It is one of components of the Welles Wilder Directional Movement indicators. Indicators · Accumulation Distribution Line (ADL) · Aroon Indicator · Average True Range (ATR) · Commodity Channel Index (CCI) · DMI/ADX · MACD. EMA Period #1. EMA. Accumulation/Distribution Accumulative Swing Index ADX/DMS Alligator Anchored VWAP Aroon Aroon Oscillator ATR Bands ATR Trailing Stops Average True Range. Technical Indicators ; STOCH (9,6), ; STOCHRSI (14), ; MACD (12,26), 5 ; CCI (14), ; ATR (14), Average True Range (ATR) is a technical indicator that measures volatility. SPY · Moving Averages vs. Pivot Points · Are You Guessing Too Much as an Option. The indicator known as average true range (ATR) can be used to develop a complete trading system or be used for entry or exit signals as part of a strategy. Get a technical analysis of SPDR S&P ETF Trust (SPY) with the latest MACD of and RSI of Stay up-to-date on market trends with our expert. The ATR (Average True Range) for SPY (S&P ETF) is a measure of volatility that is calculated based on the true range of price movements over a specified. The Average True Range (ATR) is a tool used in technical analysis to measure volatility. Unlike many of today's popular indicators, the ATR is not used to. Chart Library · Accumulation Distribution · ADX - Average Directional Index · Aroon · Aroon Oscillator · ASI - Accumulation Swing Index · ATR - Average True. Average True Range indicator for [SPX] S&P Index using daily values. Technicals are widely used by investors to gauge performance, momentum etc. Spy's Stock Charts Average True Range (ATR) technical analysis - CSIMarket. To calculate the average true range, or ATR, over a number of periods, you add up the ATR of each period and then divide by the number of periods. By default. SPY stock price had positive returns 68% of the time between AM ET and AM ET, for an average return of +%. The weakest hour of trading for SPY was. The Average True Range (ATR) indicator was developed by J. Welles Wilder and is used to measure volatility. It uses High, Low and Close prices to incorporate. ATRP is used to measure volatility just as the Average True Range (ATR) indicator is. ATRP allows securities to be compared, where ATR does not. · ATR measures.