gamedevmeet.ru

Learn

What Is A Medical Loan

American Medical Loans provides personal medical loans up to $ for any medical or dental procedure. Apply online without affecting your credit score. Medical emergency loans can help you cover unexpected bills. Here's where to find them and how to apply. The Basic Short Term Loan program assists people recovering from injury, illness or with mobility issues; allows people to return home from hospital earlier. At Acorn Finance, you can see offers from multiple online lenders for free, all without impacting your credit score. Check Offers for Medical Expense Loans. Pay for medical bills with a personal loan. Get a low, fixed rate medical personal loan up to $ through Upgrade. Lock in a low fixed rate and. What Is a Medical Loan and How Does It Work? A medical loan is a personal loan that is used to pay for medical expenses. These loans are typically unsecured. Cover medical and dental expenses with a personal loan from Fairstone. Manage the cost of dental work, medical equipment, procedures, medications and more. You can check your medical loan options by completing our eligibility check. It's as easy as 1, 2. 3. Better yet, our smart search won't affect your credit. The Long Term Loans, formerly known as the Aids to Independent Living (AIL) Program loans health equipment to Home Health clients with no other available. American Medical Loans provides personal medical loans up to $ for any medical or dental procedure. Apply online without affecting your credit score. Medical emergency loans can help you cover unexpected bills. Here's where to find them and how to apply. The Basic Short Term Loan program assists people recovering from injury, illness or with mobility issues; allows people to return home from hospital earlier. At Acorn Finance, you can see offers from multiple online lenders for free, all without impacting your credit score. Check Offers for Medical Expense Loans. Pay for medical bills with a personal loan. Get a low, fixed rate medical personal loan up to $ through Upgrade. Lock in a low fixed rate and. What Is a Medical Loan and How Does It Work? A medical loan is a personal loan that is used to pay for medical expenses. These loans are typically unsecured. Cover medical and dental expenses with a personal loan from Fairstone. Manage the cost of dental work, medical equipment, procedures, medications and more. You can check your medical loan options by completing our eligibility check. It's as easy as 1, 2. 3. Better yet, our smart search won't affect your credit. The Long Term Loans, formerly known as the Aids to Independent Living (AIL) Program loans health equipment to Home Health clients with no other available.

A medical loan is a form of personal loan that you can avail of in the event of a medical emergency. Medical loans from OneMain Financial can be used to pay off healthcare expenses from emergency or planned medical procedures. Apply online today. Jewish Free Loan Association, a nonprofit organization, covers all the costs, fees, and interest that usually comes with borrowing money. JFLA offers 0%. Overwhelmed by Healthcare Bills? Medical Loans Can Help. Your health waits for no one, and neither do our loan approvals. Apply Now. A medical loan is a personal loan that you use for medical-related expenses. A personal loan gives you a lump sum of money that you'll pay back in monthly. With a medical loan from Investkraft, one can secure funds of up to Rs. 35 lahks. The loan value can range from Rs. 1 lakh to Rs. 35 lahks. If you're looking for a loan to cover the expense of an urgent medical procedure and you see a creditor offering “financing at zero interest for a year,”. Here's what you need to know to help you find the best personal loan for medical expenses, as well as your other options for covering the cost of health care. Medical financing with low, fixed-interest rates for those with good credit, from LightStream. Loan amounts from $ to $ Learn more now. One option for a medical loan with bad credit is to apply for a personal loan from a traditional bank or credit union. These institutions may be more willing to. Help pay for your the medical care you need with loans up to $40K from Discover Personal Loans. Cover unexpected expenses, braces, LASIK, and more. To qualify for the best medical loans, you'll have to meet even stricter eligibility requirements — usually a good credit history and a score of or above. You can check your medical loan options by completing our eligibility check. It's as easy as 1, 2. 3. Better yet, our smart search won't affect your credit. Whether you are looking for a medical loan, dental loan, or cosmetic surgery loan to cover medical bills and treatments, Pepper Money can help. Apply now. We provide access to loans through Prosper, with flexible terms, fixed monthly payments 3, and no prepayment penalties. Medical loans from OneMain Financial can be used to pay off healthcare expenses from emergency or planned medical procedures. Apply online today. Medical Loan Finance Company Financing Medical Procedures. We specialize in helping people with their financing needs for their medical / dental procedures. A medical loan is a type of loan that provides financial protection against expenses that you might need to pay if you have an unexpected medical emergency. Eligibility for government loans is based on your Free Application for Federal Student Aid (FAFSA). Every medical student seeking loans should complete a FAFSA. Yes, you can get a loan for surgery. Medical loans are typically general-use personal loans that can be used to finance medical expenses such as surgeries and.

Balenciaga Stock

Balenciaga creative director Demna took over the New York Stock Exchange for the brand's Resort collection, showing a mix of old world glamour and. The Group manages the development of a series of renowned Houses in Fashion, Leather Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta, Balenciaga. ; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range Order the eyeglasses Balenciaga BBO Black Large: in Stock and available in many colors. Free shipping ✓ Quick Delivery ✓ Free Return ✓ Best. Search from thousands of royalty-free Balenciaga stock images and video for your next project. Download royalty-free stock photos, vectors, HD footage and. Find Balenciaga stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. The company provides Gucci, Saint Laurent, Bottega Veneta, Balenciaga FAQ. What Is the Kering (PRTP) Stock Price Today? The Kering stock price today is Balenciaga BBO. Balenciaga BBO. $ Free lenses. 2 colors. 2 left in stock · Eco. Balenciaga BBO. Balenciaga BBO. $ See Balenciaga funding rounds, investors, investments, exits and more. Evaluate their financials based on Balenciaga's post-money valuation and revenue. Balenciaga creative director Demna took over the New York Stock Exchange for the brand's Resort collection, showing a mix of old world glamour and. The Group manages the development of a series of renowned Houses in Fashion, Leather Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta, Balenciaga. ; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range Order the eyeglasses Balenciaga BBO Black Large: in Stock and available in many colors. Free shipping ✓ Quick Delivery ✓ Free Return ✓ Best. Search from thousands of royalty-free Balenciaga stock images and video for your next project. Download royalty-free stock photos, vectors, HD footage and. Find Balenciaga stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. The company provides Gucci, Saint Laurent, Bottega Veneta, Balenciaga FAQ. What Is the Kering (PRTP) Stock Price Today? The Kering stock price today is Balenciaga BBO. Balenciaga BBO. $ Free lenses. 2 colors. 2 left in stock · Eco. Balenciaga BBO. Balenciaga BBO. $ See Balenciaga funding rounds, investors, investments, exits and more. Evaluate their financials based on Balenciaga's post-money valuation and revenue.

BALENCIAGA WHITE LEATHER EVERYDAY CAMERA BAG SMALL (). In stock online. $1, or 4 interest-free payments of $ BALENCIAGA BBO eyeglasses 2. %. In Stock. BALENCIAGA. BALENCIAGA BBO eyeglasses · BALENCIAGA. Stock Status Stock Status / QTY on Hand. In Stock items · Out of Stock 10 items. Stock Availability. Low Stock 18 items · Medium Stock. Find 44 balenciaga stock videos in 4K and HD for creative projects. Explore over 30 million high-quality footage and royalty-free video clips. Kering traded at this Wednesday September 4th, decreasing or percent since the previous trading session. Looking back, over the last four weeks. Balenciaga Paris White,Stock Polo,all sizes · Reviews (0) · Shipping & Delivery. Reviews (0). Reviews. Founded by Cristobal Balenciaga in , the Balenciaga House is In Stock. Sale! Add to Wishlist. Balenciaga BBO Black. From: £ In Stock. Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, Dodo, Qeelin, Ginori , as well as Kering Eyewear and Kering Beauté. By placing creativity. You can watch PPRUY and buy and sell other stock and options commission-free on Robinhood. Change the date range, see whether others are buying or selling. Browse Balenciaga Sneakers and buy or sell at market prices on StockX, the live marketplace for StockX Verified Balenciaga Sneakers. Balenciaga Chocolate Brown City Bag with oversized grommets. Regular price: $1, Sale price: $1, Regular price. Unit price: /per. Sale Sold out. RARE New Old Stock Balenciaga LE DIX Eau De Cologne-4 Oz. ; eBay Money Back Guarantee. Get the item you ordered or your money back. ; Acorn Cats () ; Seller. Average hourly pay for Balenciaga Stock Associate: $ This salary trends is based on salaries posted anonymously by Balenciaga employees. BALENCIAGA BBO eyeglasses 2. %. In Stock. BALENCIAGA. BALENCIAGA BBO eyeglasses · BALENCIAGA. Balenciaga Everyday BBS Grey. Balenciaga Everyday BBS Only 1 item in stock - Express delivery. Balenciaga BBO. IN STOCK · Balenciaga BBO. IN STOCK. Size: L. Balenciaga BBO $ Or 4 payments of $ with Afterpay Icon. Balenciaga SS23 collection at the NY Stock Exchange. 0 Balenciaga SS23 collection at the NY Stock Exchange. 0 Balenciaga SS23 collection at the NY Stock. 13 Balenciaga Stock Manager jobs available on gamedevmeet.ru Apply to Store Manager, Stock Manager, Store Director and more! Out of stock. 3 colors. 1 €. Previous Next. 34 - bouncer sneaker 35 - bouncer sneaker 36 - bouncer sneaker 37 - bouncer sneaker 38 - bouncer sneaker

All Ashwagandha Benefits

:max_bytes(150000):strip_icc()/ashwagandha_annotated-6cfb1160dbcb4eb59c785497286373a9.jpg)

Potential Health Benefits of Ashwagandha · May Help Relieve Stress and Anxiety · May Improve Fertility · May Help You Sleep Well · May Support a Healthy Immune. * This potent root is found to balance energy levels for sustained endurance by day, and healthy sleep cycles by night.* Organic India's Ashwagandha supplement. “Ashwagandha has long been used in Ayurvedic medicine to increase energy, improve overall health and reduce inflammation, pain and anxiety,” says Dr. Lin. She. Ashwagandha is known for its role in supporting calmness.* Excessive cortisol production due to stress response can diminish activity in the prefrontal cortex. Ashwagandha is often used to help with sleep, anxiety, stress, manage cortisol. As an adaptogen it supports mind-body health. Learn about all benefits here. Ashwagandha is used to reduce levels of fat and sugar in the blood. Ashwagandha is also used as an "adaptogen" to help the body cope with daily stress, and as a. Supplementation with KSM Ashwagandha increased testosterone by 17%, semen volume by 53%, sperm concentration by %, lutenizing hormone by 34% and sperm. Ashwagandha in a combination supplement product demonstrated the potential to relieve symptoms of osteoarthritis, but it is unclear if the benefit was due to. Ashwagandha and B1 my stress, nervousness anxiety and occasional tremors in my hands just gone disappeared all together. Thank you Dr Berg. Potential Health Benefits of Ashwagandha · May Help Relieve Stress and Anxiety · May Improve Fertility · May Help You Sleep Well · May Support a Healthy Immune. * This potent root is found to balance energy levels for sustained endurance by day, and healthy sleep cycles by night.* Organic India's Ashwagandha supplement. “Ashwagandha has long been used in Ayurvedic medicine to increase energy, improve overall health and reduce inflammation, pain and anxiety,” says Dr. Lin. She. Ashwagandha is known for its role in supporting calmness.* Excessive cortisol production due to stress response can diminish activity in the prefrontal cortex. Ashwagandha is often used to help with sleep, anxiety, stress, manage cortisol. As an adaptogen it supports mind-body health. Learn about all benefits here. Ashwagandha is used to reduce levels of fat and sugar in the blood. Ashwagandha is also used as an "adaptogen" to help the body cope with daily stress, and as a. Supplementation with KSM Ashwagandha increased testosterone by 17%, semen volume by 53%, sperm concentration by %, lutenizing hormone by 34% and sperm. Ashwagandha in a combination supplement product demonstrated the potential to relieve symptoms of osteoarthritis, but it is unclear if the benefit was due to. Ashwagandha and B1 my stress, nervousness anxiety and occasional tremors in my hands just gone disappeared all together. Thank you Dr Berg.

Did you know ashwagandha contains high levels of polyphenols, mainly catechin, which is responsible for its antioxidant actions? All the parts of ashwagandha. Ashwagandha in a combination supplement product demonstrated the potential to relieve symptoms of osteoarthritis, but it is unclear if the benefit was due to. CLinically Proven Benefits of KSM® Ashwagandha · Reduces stress and anxiety · Improves mood and general sense of well-being · Improves cognition and memory. To enjoy all the health benefits of ashwagandha, like maintaining already-healthy cortisol levels to keeping stress at bay and your heart pumping at optimal. Currently, ashwagandha supplements are often promoted for stress and anxiety, sleep, male infertility, and athletic performance. These supplements typically. Adaptogens have a wide variety of other benefits, including anti-inflammatory properties, all of which can add up to less stress. Ashwagandha has been used in. I have been taking Ashwagandha for 2 years now. This has literally changed my life. 95% of my anxiety, public speaking fear and stress is. People have used ashwagandha for thousands of years to relieve stress, increase energy levels, and improve concentration. The adaptogenic herb Ashwagandha has cortisol-lowering effects and anti-inflammatory properties to help your body adapt to change and stress.3 Supplementing. Ashwagandha's benefits for men include boosting testosterone, sexual Tell them about any medical conditions you have and all the medications. Since the stress response has a wide range of effects on the human body, it is possible this action is where ashwagandha's reputation for being a 'cure all'. Ashwagandha is an herb said to help the body adapt to stress and anxiety while supporting feelings of relaxation and restfulness. Research shows these potential. Ashwagandha is packed with potent antioxidants that protect cells against damage caused by free radicals, but that's not all. Taking just 12ml of ashwagandha. Part of the nightshade family, the root has been used as a traditional rejuvenating tonic to help people of all ages with stress-related situations. The most. Sensoril ashwagandha extract supports cognitive health with clinically studied benefits for stress, sleep, mood, energy and focus. By clicking “Accept All. Conjure Ashwagandha's centuries-long history as a sleep aid and memory Clean, all-natural formula; Non-GMO; Vegan-friendly. Key Benefits. Traditionally. You may want to use ashwagandha in tea to taste its rich aroma, full flavor, and health benefits. Long-term users of the herb acknowledge ashwagandha's benefit. All About Ashwagandha: Benefits for. Sleep & More Ashwagandha is a branched herbal shrub that has been used within traditional Ayurvedic medicine for over. Several studies have shown people who took ashwagandha felt less occasional anxiety and stress over time and that the herb lowered stress hormones. To help.

11 Percent Interest Rate

The simple interest calculation only requires three inputs, which are the principal (or present value of the amount lent), the interest rate, and the number of. What are the benefits of an EMI calculator? Based on your loan amount, interest rate, and loan term, EMI calculators provide you exact monthly installment. An interest rate of 11 percent means that for every units of currency (eg, dollars, euros, etc.) you have invested or borrowed, you will earn or owe If you deposit $1, in an account with a 3% annual simple interest rate, you'll earn $30 in interest each year. That comes to $11 in interest, so the. Free compound interest calculator to find the interest, final balance, and schedule using either a fixed initial investment and/or periodic contributions. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. This calculator is commonly used to estimate your monthly payment, by filling in the following information and click "compute": Interest rate; Number of. percentage of the loan. If you don't know the interest rate, enter your credit score range to see an interest rate estimate. Once you enter your loan. 11% is a very high interest rate meant for people with no or bad credit as no one will lend money to them otherwise. The simple interest calculation only requires three inputs, which are the principal (or present value of the amount lent), the interest rate, and the number of. What are the benefits of an EMI calculator? Based on your loan amount, interest rate, and loan term, EMI calculators provide you exact monthly installment. An interest rate of 11 percent means that for every units of currency (eg, dollars, euros, etc.) you have invested or borrowed, you will earn or owe If you deposit $1, in an account with a 3% annual simple interest rate, you'll earn $30 in interest each year. That comes to $11 in interest, so the. Free compound interest calculator to find the interest, final balance, and schedule using either a fixed initial investment and/or periodic contributions. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. This calculator is commonly used to estimate your monthly payment, by filling in the following information and click "compute": Interest rate; Number of. percentage of the loan. If you don't know the interest rate, enter your credit score range to see an interest rate estimate. Once you enter your loan. 11% is a very high interest rate meant for people with no or bad credit as no one will lend money to them otherwise.

Annual Percentage Rate (APR) Calculator. Loan Amount. $. Interest Rate. %. Term. Yr. Finance Charges (Added to loan amount). $. Prepaid Finance Charges (Paid. You calculate the simple interest by multiplying the principal amount by the number of periods and the interest rate. Simple interest does not compound, and you. Rate of Interest (i): %. Number of years (n): Rate of Interest Compounded 11, , , , , , , , , , , For example, if you want to know how long it will take to double your money at eight percent interest, divide 8 into 72 and get 9 years. Interest Rate: %. Years. In this formula: I = Total simple interest; P = Principal amount or the original balance; r = Annual interest rate; t = Loan term in years. An interest rate of 11 percent means that for every units of currency (eg, dollars, euros, etc.) you have invested or borrowed, you will earn or owe The benchmark interest rate in Mexico was last recorded at percent Banxico Keeps Rate Unchanged at 11%, Meeting Expectations. The Bank of Mexico. Even a loan with a low interest rate could leave you with monthly payments that are higher than you can afford. Some personal loans come with variable interest. Interest rate - It has to be between 1 percent and 50 percent. Interest rates may vary across lenders as different lenders may offer loans at different rates. i is the interest rate per month in decimal form (interest rate percentage divided by 12) Last updated: December 11, Follow CalculatorSoup. Use this calculator to test out any loan that you are considering. By tweaking the loan amount, loan term, and interest rate, you can get a sense of the. Automatic Payment Discount* of percentage point interest rate discount. After applying for a Citizens Student Loan™, you may qualify for Multi-Year. Monthly Interest Rate = Interest Rate/12For Example, if the interest rate It can be a percentage of the amount being paid or a flat fee. It can also be. Total interest, ₹1,73, Total amount, ₹11,73, Principal amount. Interest amount. Your Amortization Details (Yearly/Monthly). An interest rate calculator. Use this calculator to determine the Annual Percentage Rate (APR) for your mortgage. For example, a loan with a lower stated interest rate may be a bad value. Annual Percentage Rate (APR). % - %* APR with AutoPay. Loan purpose. Debt consolidation, home improvement, auto financing, medical expenses, and. Updated: AM. EMI Calculator. Amount. ₹. Interest Interest Rate: The higher the personal loan interest rate, the higher will be your. Compute future returns on investments and savings. Try different interest rates, periods, starting amounts, future values, compounding frequencies. Many lines of credit permit payments equal to one percent or two percent Interest rate: The annual interest rate, often called an annual percentage rate (APR). An interest rate is a percentage that is charged by a lender to a borrower for an amount of money. This translates as a cost of borrowing. You may be borrowing.

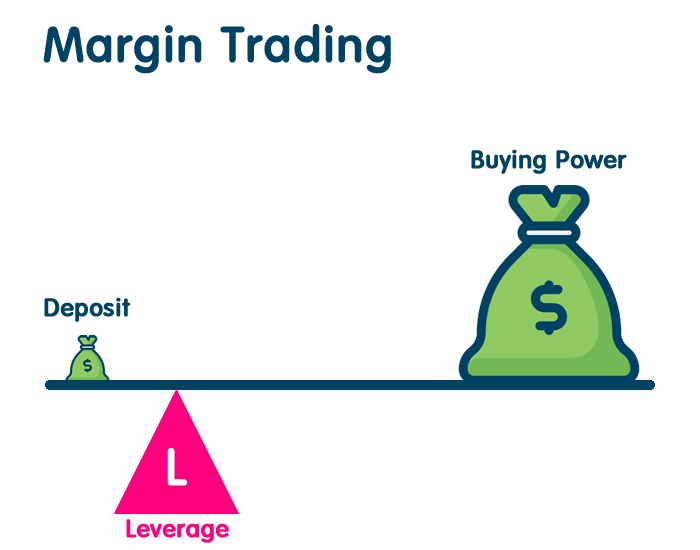

Trading Options On Margin

The initial(maintenance) margin requirement is 75% of the cost(market value) of a listed, long term equity or equity index put or call option. Watch the Margins. You can't purchase options on margin, as you can with stocks. However, some brokerage firms require that certain options transactions. Trading on margin is when you borrow money from your broker to place a trade. It's kind of like a loan and if you hold the position overnight then you will. When selling put options, the margin requirements are much lower than the actual cost of the trade. If this is not understood well, then this can lead to. A margin trading account allows you to borrow funds to trade securities in the secondary equity, options, and futures markets. Margin is a practice that allows traders to buy and sell stocks, options, and futures using less capital than the total risk of the trade. Margin requirements (applies to stock & index options) · % of the option proceeds + (20% of the underlying market value) – (OTM value) · % of the option. When an investor writes (sells) put options, they are obligated under the agreed put contract to buy the underlying asset from the put holder if the options are. Margin is essentially a loan from your broker and you will be liable for interest on that loan. The idea of buying stocks using this technique is that the. The initial(maintenance) margin requirement is 75% of the cost(market value) of a listed, long term equity or equity index put or call option. Watch the Margins. You can't purchase options on margin, as you can with stocks. However, some brokerage firms require that certain options transactions. Trading on margin is when you borrow money from your broker to place a trade. It's kind of like a loan and if you hold the position overnight then you will. When selling put options, the margin requirements are much lower than the actual cost of the trade. If this is not understood well, then this can lead to. A margin trading account allows you to borrow funds to trade securities in the secondary equity, options, and futures markets. Margin is a practice that allows traders to buy and sell stocks, options, and futures using less capital than the total risk of the trade. Margin requirements (applies to stock & index options) · % of the option proceeds + (20% of the underlying market value) – (OTM value) · % of the option. When an investor writes (sells) put options, they are obligated under the agreed put contract to buy the underlying asset from the put holder if the options are. Margin is essentially a loan from your broker and you will be liable for interest on that loan. The idea of buying stocks using this technique is that the.

Buying securities on margin allows you to acquire more shares than you could on a cash-only basis. If the stock price goes up, your earnings are potentially. U.S. investors can trade options on a wide range of financial products—from individual stocks or stock exchange-traded funds (ETFs) to indexes, foreign. For residents of Canada trading options, the complete margin requirement details are listed in the sections below. When selling call options, a cash account must have at least shares (round-lot) of stock per call option sold. As a result of not having any access to. For stock, equity options, narrow based indices and single stock futures, the stress parameter is plus or minus 15%, with eight other points within that range. Margin in derivatives trading refers to the collateral deposit required from the trading counterparties as a form of security to ensure contract fulfillment. A margin is an amount that is calculated by ASX Clear as necessary to ensure that you can meet that obligation of your entire Options portfolio on that trading. What are the margin requirements for options? ; Long (Buy) Call or Put. % of the option's premium. ; Covered Write (selling a call covered by long position, or. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or. A margin is an amount that is calculated by ASX Clear as necessary to ensure that you can meet that obligation of your entire Options portfolio on that trading. Buying on margin is borrowing money from a broker in order to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. Margin trading increases your level of market risk. Your downside is not limited to the collateral value in your margin account. Schwab may initiate the sale of. So let's start with what margin is when it comes to trading. Margin is the amount of money that you hold in your account to enter into a trade. It is used as. Options margin is the cash or securities an investor must deposit in his account as collateral before writing (selling) options. Margin in options trading is the collateral you need to write or sell options. This collateral can be in the form of cash or underlying securities for the. You can request to add options trading to your account by submitting a completed Options and Margin Agreement form. To search for a stock, click the search. An option is a contract enabling the purchase or sale of a specific security at a specific price during a specific time period. In the options market, the two. When trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more.

Cad 5

5-Letter Words Starting with CAD: Caddo, caddy, cadee, cadet, cadge, cadgy, cadie, cadis, cadre. Collaboration for groundbreaking designs. See how Workshop/APD uses AutoCAD and Revit together for multidisciplinary teams. (video: min.). The change for CAD to USD was The performance of CAD to USD in the last 90 days saw a 90 day high of and a 90 day low of This means. 5 port Ethernet Switch. SX5E-HUB. 5 port Ethernet Switch. SX5E CAD Files. 2D gamedevmeet.ru, 04/26/, SIGN IN TO DOWNLOAD · 3D gamedevmeet.ru, 10/ British Pound / Canadian Dollar Historical Reference Rates from Bank of England for to ; September - · 1. 2 ; August - · 1. 2. 3. 4. 5. The World Leader in Powerful & Affordable CNC CAD/CAM Software Solutions. Get the latest 5 Canadian Dollar to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about. Get the latest 5 US Dollar to Canadian Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for USD to CAD and learn more. Canadian Dollars to US Dollars conversion rates ; 1 USD, CAD ; 5 USD, CAD ; 10 USD, CAD ; 25 USD, CAD. 5-Letter Words Starting with CAD: Caddo, caddy, cadee, cadet, cadge, cadgy, cadie, cadis, cadre. Collaboration for groundbreaking designs. See how Workshop/APD uses AutoCAD and Revit together for multidisciplinary teams. (video: min.). The change for CAD to USD was The performance of CAD to USD in the last 90 days saw a 90 day high of and a 90 day low of This means. 5 port Ethernet Switch. SX5E-HUB. 5 port Ethernet Switch. SX5E CAD Files. 2D gamedevmeet.ru, 04/26/, SIGN IN TO DOWNLOAD · 3D gamedevmeet.ru, 10/ British Pound / Canadian Dollar Historical Reference Rates from Bank of England for to ; September - · 1. 2 ; August - · 1. 2. 3. 4. 5. The World Leader in Powerful & Affordable CNC CAD/CAM Software Solutions. Get the latest 5 Canadian Dollar to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about. Get the latest 5 US Dollar to Canadian Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for USD to CAD and learn more. Canadian Dollars to US Dollars conversion rates ; 1 USD, CAD ; 5 USD, CAD ; 10 USD, CAD ; 25 USD, CAD.

The United States National CAD Standard (NCS) streamlines and simplifies the New in NCS Version 5 · NCS Version 5 Content · Presentation - Ecobuild. Convert 5 US Dollars to to Canadian Dollars by excellent exchange rate in the USA today. Join 45+ million happy customers and avoid high fees when you. Continue Reading About CAD (computer-aided design). 5 tips to optimize CAD application performance for VDI · The IoT journey for manufacturers: Concept. These forecasts are provided to Governing Council in preparation for monetary policy decisions. They are released once a year with a five-year lag. Search. This easy-to-use free CAD software, being a legacy version 5 of the platform, is suitable for both individual and business use on non-profit projects. With a daily trading volume of more than $ trillion, the forex market is the most traded in the world, and is open 24 hours a day, five days a week, between. ISO Technical product documentation — Lettering — Part 5: CAD lettering of the Latin alphabet, numerals and marks. The United States National CAD Standard (NCS) version 5 is comprised of the Foreword, Administration, AIA CAD Layer Guidelines, Uniform Drawing System. Convert 5 CAD to MXN with the Wise Currency Converter. Analyze historical currency charts or live Canadian dollar / Mexican peso rates and get free rate. A 3D model of the OPI 5 becomes available then a lot of people, including myself, can begin making cases and things like ice tower adapters for the OPI 5. Category 5 cable (Cat 5) is a twisted pair cable for computer networks. Since , the variant commonly in use is the Category 5e specification (Cat 5e). DoubleCAD XT is an AutoCAD LT work-alike. But free. It's also 5-Star Rated from the editors at CNET and the #1 most downloaded free CAD at gamedevmeet.ru CAD cell line, ECACC, from mouse embryo. Active Filters 5 stars Remove Filter 5 stars ✘; Active Filters sq Remove. CAD/CAM #5 Crown & Implant Design This accelerated program prepares students to be Dental CAD/CAM Technicians. Students will work with a variety of materials. CAD. Catalogue No. Cell Line Name. CAD. Cell Line Description. CAD cells Split cultures to seeding at 3 X 10⁴ cells/cm² ;5% CO₂; 37°C. With ETOOLBOX® MOBILE CAD TOOLS, CAD file uploads will not be required. Read February 5, Azle, Texas, USA. CAD-MANUFACTURING SOLUTIONS, INC. Online CAD and PDM platform powering today's innovators. See how companies eliminate bottlenecks, streamline design collaboration, and work anywhere, on any. CAD Support Team (Children and Adults with Disabilities). Who are we? The team is a multi-disciplinary team consisting of Specialist Teachers. 5-letter words starting with CAD. ATTENTION! Please see our Crossword & Codeword, Words With Friends or Scrabble word helpers if that's what you're looking for. Current exchange rate US DOLLAR (USD) to CANADIAN DOLLAR (CAD) including currency converter, buying & selling rate and historical conversion chart p p.

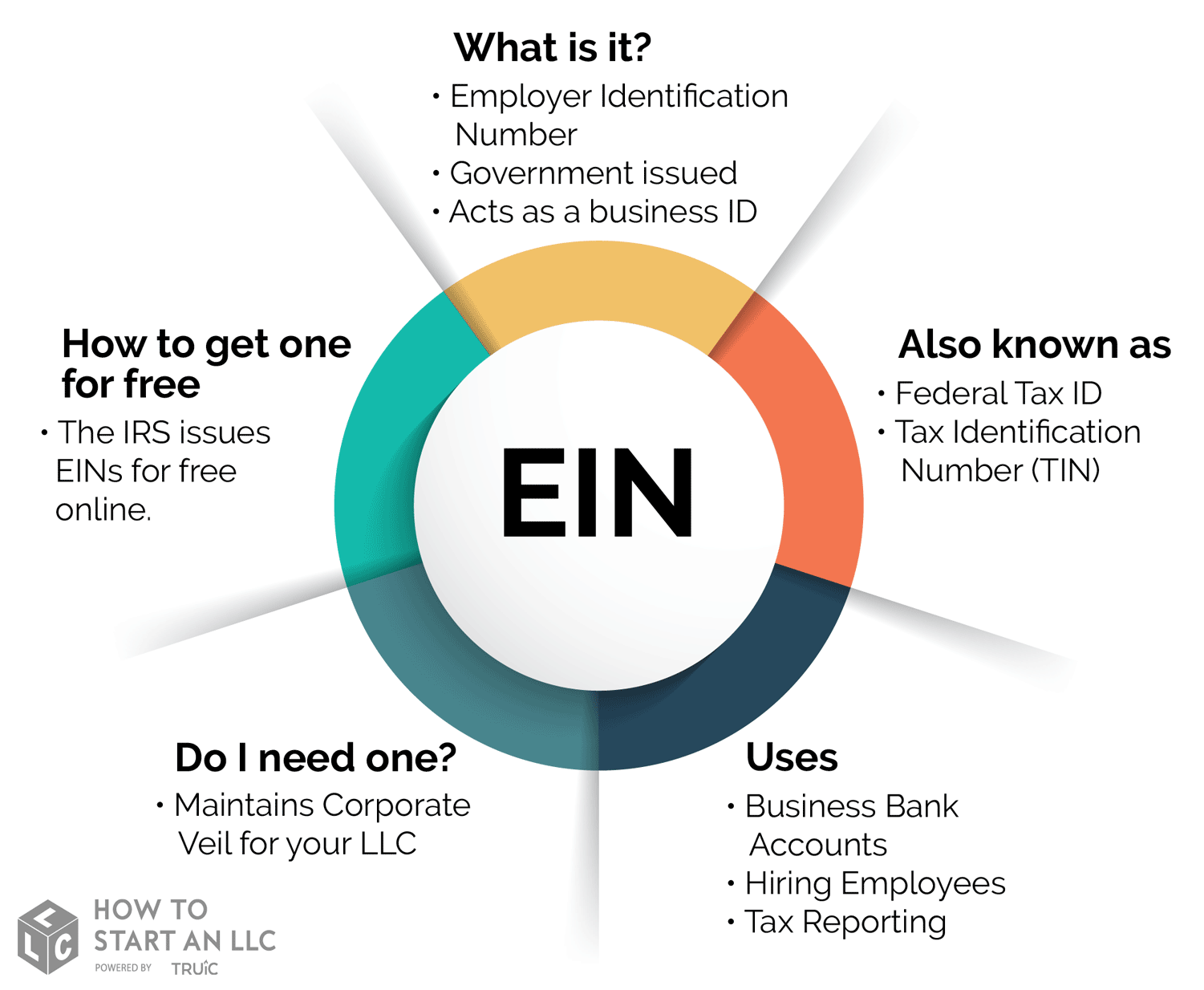

Ein Number Definition

An EIN is a unique nine-digit number assigned to a business by the IRS. · It's used to report taxes and for legal purposes, such as filing for contracts or loans. The IRS definition of a Tax ID Number is “a Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the. When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be. Example of EIN Number. EIN is unique for each individual /entity. · What is the difference between EIN and TIN? TIN stands for Taxpayer Identification Number. Employer Identification Number (EIN): A nine-digit number used to identify the tax accounts of employers and certain others who don't have employees. Find the legal definition of EMPLOYER IDENTIFICATION NUMBER (EIN) from Black's Law Dictionary, 2nd Edition. An IRS-generated, unique identifier (ID) used to. Taxpayer Identification Number (TIN) and Employer Identification Number (EIN) are defined as a nine-digit number that the IRS assigns to organizations. This number is also referred to as a Federal Tax ID Number. Generally, all businesses need an FEIN. Many one-person businesses use their Social Security Number. An Employer Identification Number (EIN) is a unique nine-digit number assigned to US business entities. An EIN is a unique nine-digit number assigned to a business by the IRS. · It's used to report taxes and for legal purposes, such as filing for contracts or loans. The IRS definition of a Tax ID Number is “a Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the. When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be. Example of EIN Number. EIN is unique for each individual /entity. · What is the difference between EIN and TIN? TIN stands for Taxpayer Identification Number. Employer Identification Number (EIN): A nine-digit number used to identify the tax accounts of employers and certain others who don't have employees. Find the legal definition of EMPLOYER IDENTIFICATION NUMBER (EIN) from Black's Law Dictionary, 2nd Edition. An IRS-generated, unique identifier (ID) used to. Taxpayer Identification Number (TIN) and Employer Identification Number (EIN) are defined as a nine-digit number that the IRS assigns to organizations. This number is also referred to as a Federal Tax ID Number. Generally, all businesses need an FEIN. Many one-person businesses use their Social Security Number. An Employer Identification Number (EIN) is a unique nine-digit number assigned to US business entities.

EIN. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is. What is an Employer Identification Number (EIN)?. Sometimes also referred to as a Federal Employer Identification Number (FEIN), an EIN is a unique, nine-digit. EIN or Employer Identification Number is a unique 9 digit number owned by business entities and is assigned by IRS (Internal Revenue Services). Employer identification numbers are used to identify employers. For the definition of social security number and employer identification number, see. The EIN is a unique number that identifies the organization to the Internal Revenue Service. To apply for an employer identification number, you should obtain. An employer identification number (EIN) is a unique number that business entities have so that the IRS can easily identify them. Employer Identification Number, EIN · It is a unique identifier that is assigned to a business entity for easy identification by the revenue department. · This. What is an Employer Identification Number (EIN)?. Updated: August 24, What is an EIN? Definition and meaning. An employer identification number (EIN). FEIN is an acronym for Federal Employer Identification Number. Click to get the full FEIN definition here, along with links to additional resources! Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a. An EIN (employer identification number) identifies a business entity for tax purposes. It's also known as a federal tax identification number. An Employer Identification Number (EIN) is a unique nine-digit number issued by the Internal Revenue Service (IRS) in the United States. It's also known as a. Employer Identification Number (EIN) is a nine-digit number assigned to organizations by the IRS. The format is XX-XXXXXXX. Employer Identification Numbers (EIN) are used for tax administration and to identify business entities. Learn how having an EIN can benefit your business. An FEIN is the identifying number that the federal Internal Revenue Service (IRS) uses to identify a business based on payroll and tax records. This form of. To ensure fair and equitable treatment for all taxpayers, Employer Identification Number (EIN) issuance is limited to one per responsible party per day. This. ENTITY IDENTIFICATION NUMBER (EIN). A three-part coding scheme of twelve characters used to identify organizations and individuals. For more information visit our privacy policy. Accept All Cookies. EIN Number definition. An Employer Identification Number is a unique nine-digit number issued by the IRS to businesses for tax purposes. Learn how to apply and how to find a. An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used to identify a business entity.

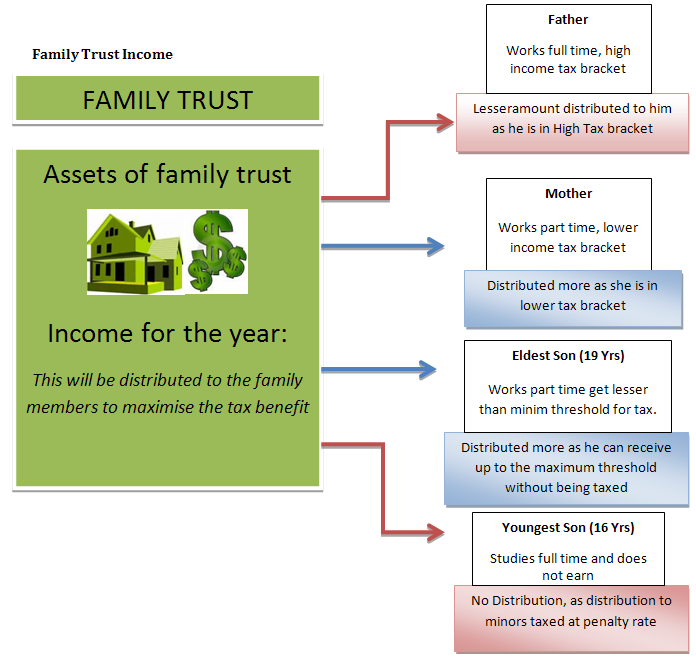

Family Trust Tax Benefits

Transferring assets to a revocable trust will remove those assets from your estate for state probate law purposes but not for federal (or state) estate tax. Why establish a trust? · Providing for family members if something should happen to you · Dictating the distribution of your assets to specific beneficiaries. In some cases, irrevocable trusts can avoid estate taxes as well as inheritance taxes. The trust itself will pay its own income taxes. Any money put into a. The benefit of transferring assets to an irrevocable trust is that you get the future appreciation out of your estate for estate tax purposes. A nonresident trust is any taxpayer trust that is not a resident trust. Trusts That Are Not Pennsylvania Taxpayers A trust for Pennsylvania personal income tax. For a trust that pays its own income taxes, what deductions can the trust claim? · Trustee Fees and Tax Return Preparer Fees · Income Distribution Deduction. Trusts reach the highest federal marginal income tax rate at much lower thresholds than individual taxpayers, and therefore generally pay higher income taxes. What Are the Tax Advantages of a Trust? Irrevocable trusts allow amounts to be contributed annually without being subject to gift taxes. The annual exclusion. Benefits of trusts · Protecting and preserving your assets. · Customizing and controlling how your wealth is distributed. · Minimizing federal or state taxes. Transferring assets to a revocable trust will remove those assets from your estate for state probate law purposes but not for federal (or state) estate tax. Why establish a trust? · Providing for family members if something should happen to you · Dictating the distribution of your assets to specific beneficiaries. In some cases, irrevocable trusts can avoid estate taxes as well as inheritance taxes. The trust itself will pay its own income taxes. Any money put into a. The benefit of transferring assets to an irrevocable trust is that you get the future appreciation out of your estate for estate tax purposes. A nonresident trust is any taxpayer trust that is not a resident trust. Trusts That Are Not Pennsylvania Taxpayers A trust for Pennsylvania personal income tax. For a trust that pays its own income taxes, what deductions can the trust claim? · Trustee Fees and Tax Return Preparer Fees · Income Distribution Deduction. Trusts reach the highest federal marginal income tax rate at much lower thresholds than individual taxpayers, and therefore generally pay higher income taxes. What Are the Tax Advantages of a Trust? Irrevocable trusts allow amounts to be contributed annually without being subject to gift taxes. The annual exclusion. Benefits of trusts · Protecting and preserving your assets. · Customizing and controlling how your wealth is distributed. · Minimizing federal or state taxes.

A nonresident trust is any taxpayer trust that is not a resident trust. Trusts That Are Not Pennsylvania Taxpayers A trust for Pennsylvania personal income tax. In most cases, the settlor cannot be sole trustee of an irrevocable trust without losing the intended tax benefits. Specific-Use Trusts. Trusts can be tailored. In addition, and in general, estate tax laws often change.) What are the advantages of a revo- cable living trust compared to a will? RLTs offer some advantages. A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries Individuals and families · Businesses and. Tax treatment - Family trusts allow estate tax exemptions to pass to spouses and heirs. Different rules may apply to regular trusts. Governing structure - The. Planning for what will happen to your wealth when you're gone can be hard to think about. Doing so now, though, can benefit you and your family, and it can. Family trusts offer several benefits, including Asset protection, Special Child lifecare, Estate planning, Probate avoidance, Tax planning and Continuity. Types. Family trust pros · Avoid probate. Unlike with a will, assets in a family trust can be transferred to beneficiaries without probate, making the process more. Assets in the trust are subject to federal estate and gift taxes (though no tax may be due if you have a sufficient amount of exemption remaining) only once -. A family trust allows trustees to distribute earned income to family members who are in a lower income tax bracket, so the income (e.g., capital gains. A Family Trust can be used to distribute tax exemptions and liabilities for specific asset classes. Here are the tax benefits of a Family Trust. When you put money or property in a trust, provided certain conditions are met, you no longer own it. This means it might not count towards your Inheritance. The primary advantage of setting up a family trust is to ensure your immediate family members get the financial resources they need after you die. Family trusts. Trusts can be hugely beneficial for income tax purposes in the right circumstances. If a trust is not settlor-interested (ie where the settlor, their spouse/. With an irrevocable living trust, there might be gift tax liability and/or a reduction of the federal unified exemption. True ______ False ______. 9. Probate. An additional benefit of placing capital property into a trust is that any property placed into a trust should not be subject to estate administration tax . Income not distributed is still taxable to the trust. Tax Advantages And Benefits Of Including A Revocable Living Trust In Your Estate Plan. There are many. A Family Trust can be used to distribute tax exemptions and liabilities for specific asset classes. Here are the tax benefits of a Family Trust. Revocable trusts also called living trusts, are one of the more frequently Tax Benefits of Charitable Remainder Trusts. A number of tax benefits are.

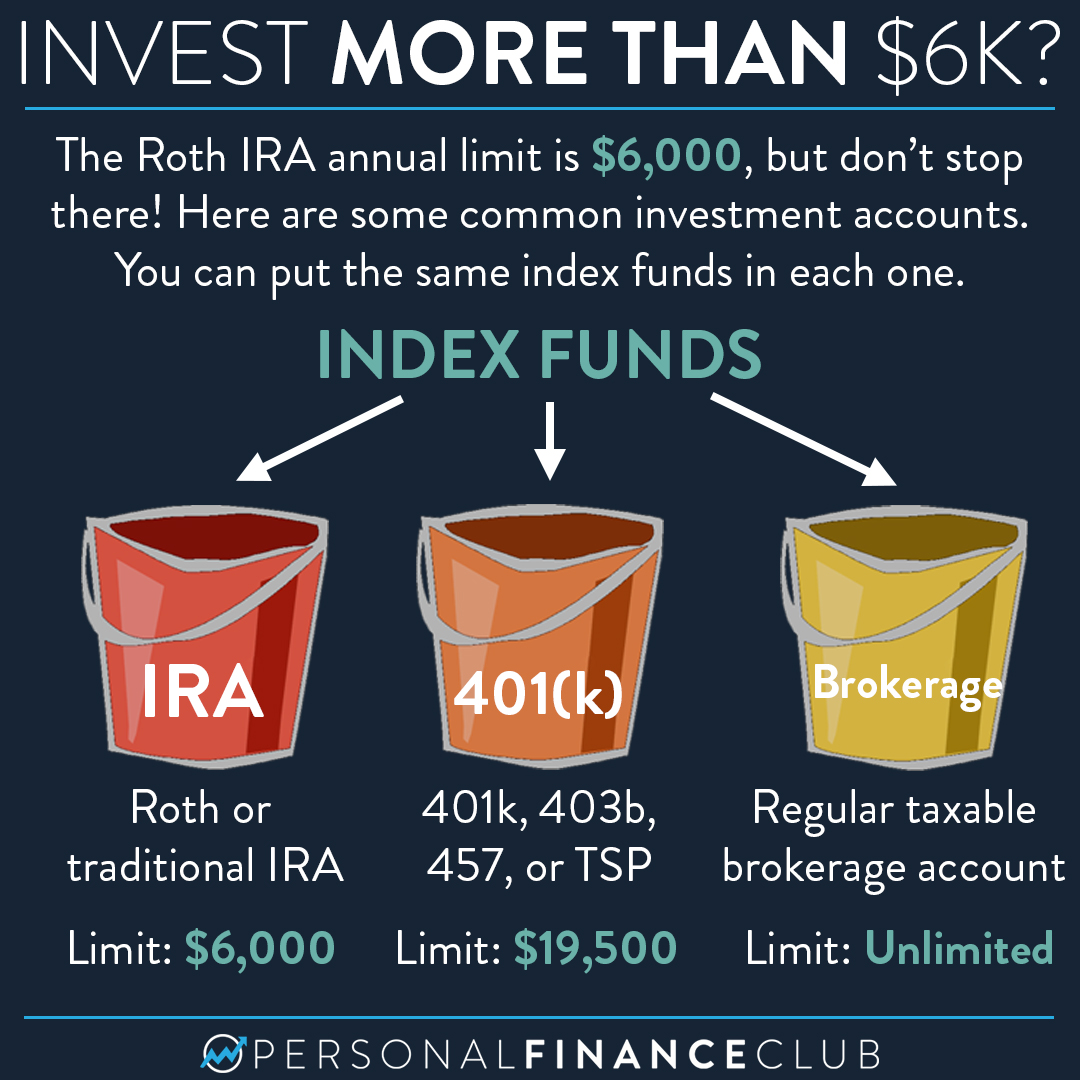

Is Roth Ira An Investment Account

A Roth IRA is a retirement account where you can make after-tax, non-deductible contributions and then make withdrawals tax-free during retirement. Roth IRAs offer tax-free growth potential. Investment earnings are distributed tax-free when the account has been funded for more than five years and you. Yes, you want both accounts. Roth is long term tax free investing for retirement money. I mostly use equity mutual funds for this. Brokerage. All contributions to a Roth IRA are made on an after-tax basis, but the Roth IRA provides the opportunity for tax-free investment earnings and tax-free. A Roth IRA could be an important part of your investment portfolio, especially if you expect to be in a higher bracket when you're ready to retire. A Roth. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. A Roth individual retirement account (IRA) is a retirement account that gives you a chance to grow your money over time by investing already-taxed dollars in a. IRAs are seen as long-term investment vehicles while a brokerage account allows for short-term investment opportunities and withdrawals. A Roth IRA is a retirement account where you can make after-tax, non-deductible contributions and then make withdrawals tax-free during retirement. Roth IRAs offer tax-free growth potential. Investment earnings are distributed tax-free when the account has been funded for more than five years and you. Yes, you want both accounts. Roth is long term tax free investing for retirement money. I mostly use equity mutual funds for this. Brokerage. All contributions to a Roth IRA are made on an after-tax basis, but the Roth IRA provides the opportunity for tax-free investment earnings and tax-free. A Roth IRA could be an important part of your investment portfolio, especially if you expect to be in a higher bracket when you're ready to retire. A Roth. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. A Roth individual retirement account (IRA) is a retirement account that gives you a chance to grow your money over time by investing already-taxed dollars in a. IRAs are seen as long-term investment vehicles while a brokerage account allows for short-term investment opportunities and withdrawals.

An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. TD Ameritrade offers a large range of investment options, including stocks, bonds, ETFs, mutual funds, futures, bitcoin futures, and more. Account Minimum. $0. With Roth IRAs, however, you pay taxes upfront by contributing after-tax dollars and later in retirement your withdrawals are tax-free (as long as your account. A Roth IRA is a type of individual retirement account that provides tax-free withdrawals in the future in exchange for making after-tax contributions now. Tax-Free Growth and Withdrawals: With a Roth IRA, your contributions are made with after-tax dollars, but your investments grow tax-free, and qualified. All contributions to a Roth IRA are made on an after-tax basis, but the Roth IRA provides the opportunity for tax-free investment earnings and tax-free. A Roth Individual Retirement Account, or Roth IRA, is an investment account that helps you save for retirement and reduce taxes. Fidelity's Roth IRA puts savers in the driver's seat and requires that they choose their own investments. As a result, this account doesn't charge any advisory. A Roth IRA is an individual retirement account that allows people below a certain income ceiling to contribute a fixed amount of money each year and invest it. Many companies offer a Roth IRA, including banks, brokerages and robo-advisors, and each allows you to make various types of investments. IRAs allow you to make tax-deferred investments to provide financial security when you retire. A Roth IRA is a retirement account option funded with after Investment account options; Retirement accounts. Retirement accounts. What is a. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. A Roth IRA is an investing account designed for retirement savings. Find out how the Roth IRA works, if you're eligible, and if it may be the right. Best Roth IRAs · Best for experienced investors: Charles Schwab® Roth IRA · Best for beginner investors eager to learn: Fidelity Investments Roth IRA · Best for. Roth IRAs are individual retirement accounts that you contribute to with after-tax dollars (income you've already paid taxes on). Invest in a Roth IRA at T. Rowe Price. Find out how you can take advantage IRA, or cashing out the account value. When deciding between an employer. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. The short answer is no. The biggest difference between an IRA and a mutual fund is that an IRA is a type of account that can be funded with an investment like a.

Difference Between Market And Limit

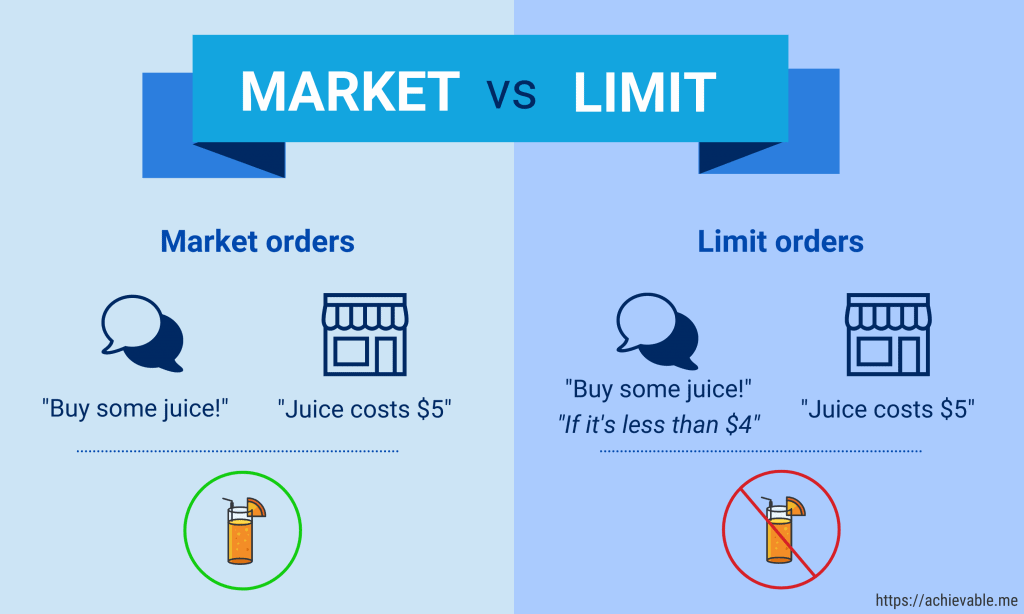

The most common types of orders are market orders, limit orders, and stop-loss orders. A market order is an order to buy or sell a security immediately. A limit order is an instruction to buy or sell an asset such as a security at a set price or better on the stock exchange. This type of order offers investors. While market orders can leave a buyer or seller exposed to changes in the current price available in the market, limit orders allow you to decide at what price. But if you're in a hurry to buy or sell, a market order may be the better option. Here is a table that summarizes the key differences between. The following is the distinction between a market order and a limit order: In a stock market, a market order is a purchase or sell order in which investors. The difference between the two order types is quite simple. Limit orders enable you to enter a position at a price determined by you, with no actual. With a limit order, you're stipulating that you want the transaction only to occur at a particular price or better, even though there is a possibility the order. A market order is concerned with the orders wherein trading of the monetary instruments will be executed on the available price or cost at that point of. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell. The most common types of orders are market orders, limit orders, and stop-loss orders. A market order is an order to buy or sell a security immediately. A limit order is an instruction to buy or sell an asset such as a security at a set price or better on the stock exchange. This type of order offers investors. While market orders can leave a buyer or seller exposed to changes in the current price available in the market, limit orders allow you to decide at what price. But if you're in a hurry to buy or sell, a market order may be the better option. Here is a table that summarizes the key differences between. The following is the distinction between a market order and a limit order: In a stock market, a market order is a purchase or sell order in which investors. The difference between the two order types is quite simple. Limit orders enable you to enter a position at a price determined by you, with no actual. With a limit order, you're stipulating that you want the transaction only to occur at a particular price or better, even though there is a possibility the order. A market order is concerned with the orders wherein trading of the monetary instruments will be executed on the available price or cost at that point of. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell.

A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. Risk tolerance: Market orders carry a higher risk of price fluctuations, while limit orders provide greater control over the execution price. Risk-averse. While a limit order focuses on price, market orders focus on quickly fulfilling the order. For example, lets say you want to place a market order to buy stock. A market/limit order is an order to buy or sell a single security that you send immediately to the market, rather than placing a window trade. When you place a market order, you are asking to buy or sell promptly at the current market price. With a limit order, you're stipulating that you want the. In contrast, stop orders revolve around executing a trade once the share price reaches a certain level, regardless of whether that price is above or below the. With a Limit Order you set a minimum price (in case of a sell) or maximum price (in case of a buy) for which you want to execute your order. Your order will. A market order is concerned with the orders wherein trading of the monetary instruments will be executed on the available price or cost at that point of. A Market-to-Limit (MTL) order is submitted as a market order to execute at the current best market price. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. Like market orders, traders use limit orders to enter and exit a market. However, the orders are placed in a queue at the exchange, where they wait until price. It also protects you from the possibility of getting picked off by a high ask lurking in the order book. Again, I'm sure there are better. Risk tolerance: Market orders carry a higher risk of price fluctuations, while limit orders provide greater control over the execution price. Risk-averse. A stop-loss order triggers a market order when a designated price is hit, whereas a stop-limit order triggers a limit order when a designated price is hit. Time. A market order is a request to a broker to open a trade immediately at the best possible price. This means the trade is executed quickly, but only if there's. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. Market order vs Limit order: Key differences A market order is an order to buy or sell an asset immediately, placing a trade execution at that time for the. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Market orders are transactions meant to execute as quickly as possible at the current market price. Limit orders set the maximum or minimum. It also protects you from the possibility of getting picked off by a high ask lurking in the order book. Again, I'm sure there are better.