gamedevmeet.ru

Market

How Much Home Afford Calculator

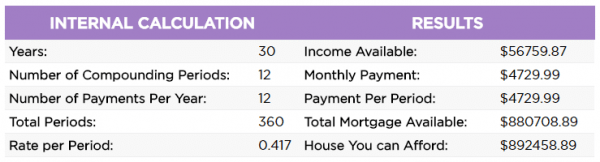

If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. Our easy-to-use Home Affordability Calculator can help you determine your comfortable price range. And once you know your targeted budget, you can estimate. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. How much house can I afford? Use the TD mortgage affordability calculator to determine a comfortable mortgage loan and price range for your new home. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. This affordability slider helps you decides how much of your disposable income is allocated to mortgage payments, home expenses and monthly debt payments. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. Our easy-to-use Home Affordability Calculator can help you determine your comfortable price range. And once you know your targeted budget, you can estimate. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. How much house can I afford? Use the TD mortgage affordability calculator to determine a comfortable mortgage loan and price range for your new home. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. This affordability slider helps you decides how much of your disposable income is allocated to mortgage payments, home expenses and monthly debt payments.

Use the Home Affordability calculator from North American Savings Bank to calculate how much you can spend on your home based on a few simple questions. How much house can I afford? Buying a home is a major commitment and many factors determine what a mortgage lender is willing to offer. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage application. This calculator will give you a better idea of how much you can afford to pay for a house and what the monthly payment will be. How much mortgage can you afford? Check out our simple mortgage affordability calculator to find out and get closer to your new home. To know how much house you can afford, an affordability calculator can help. Getting pre-approved for a loan can help you find out how much you're qualified to. Learn how much house you can afford and how to improve your mortgage affordability with Rocket Homes Home Affordability Calculator. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. Feel confident about buying a house that you can afford. This calculator will show you how much home you can afford and at different down payment amounts. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Most loans require that your DTI not exceed 45%. How do I calculate my monthly mortgage payment? Once you know the home price you can afford, use our Mortgage. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Find out how much home you could afford and estimate what your monthly mortgage payment could be. The first step in buying a house is determining your budget. Use this calculator to see how much your mortgage could cost and how much you can afford. By changing any value in the following form fields, calculated values. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. Fifth Third Bank's Mortgage Affordability Calculator helps estimate how much home you can afford and which mortgage payments will work for your budget.

How To Put Money On Google Pay

Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Add funds to Samsung Pay Cash · To add money, open the Samsung Wallet app on your phone, tap the Quick access tab at the bottom of the screen, and then swipe to. Seamless payments across all of your devices begin with a few quick steps. Add your card details to your Google Account, and they will be stored safely. Using Google Pay Is as Easy as 1 - 2 - 3 ; One. Simply unlock your phone, no need to open the Google Pay app. ; Two. Hold your phone close to the payment terminal. Just add your Huntington debit or credit card information to the app and start shopping! Contactless Payments. Using Google Pay in stores helps you avoid. Option 1 (in Google Wallet): · Open your Clipper card · Select the "Add money or pass" option in the card · Select the payment method and the cash value you would. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if needed. You're all set! Can a blocked phone contact send you money through googlepay? Same as Google Pay/Google Pay | Save to phone > Add to Google Wallet. Terminology. Launch Cash App · Tap the Cash Card (this should be on the home screen) · Select 'Add to Google Pay' if available · Follow the on-screen instructions. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Add funds to Samsung Pay Cash · To add money, open the Samsung Wallet app on your phone, tap the Quick access tab at the bottom of the screen, and then swipe to. Seamless payments across all of your devices begin with a few quick steps. Add your card details to your Google Account, and they will be stored safely. Using Google Pay Is as Easy as 1 - 2 - 3 ; One. Simply unlock your phone, no need to open the Google Pay app. ; Two. Hold your phone close to the payment terminal. Just add your Huntington debit or credit card information to the app and start shopping! Contactless Payments. Using Google Pay in stores helps you avoid. Option 1 (in Google Wallet): · Open your Clipper card · Select the "Add money or pass" option in the card · Select the payment method and the cash value you would. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if needed. You're all set! Can a blocked phone contact send you money through googlepay? Same as Google Pay/Google Pay | Save to phone > Add to Google Wallet. Terminology. Launch Cash App · Tap the Cash Card (this should be on the home screen) · Select 'Add to Google Pay' if available · Follow the on-screen instructions.

To add your PayPal account through the Google Pay app for mobile purchases in-store, log in to Google Pay, tap the icon to add a new payment method, and follow. Step 1: Download and open your Google Pay app on your phone. · Step 2: Click "Get Started" · Step 3: Tap the "Add a card" button. · Step 4: Scan your card. You're. Tap the 'Add to G Pay' button and follow the onscreen instructions. Simply add or convert an ORCA card to Google Wallet™, add money or passes, and go! How to Add an ORCA Card to Google WalletHelpful Tips for Getting Started. You can add cash to your Google Pay account by linking it to a bank account or debit/credit card. You cannot directly add cash using gift. Bank points with your cash. · When you're at a participating store, choose option to load cash as your funding method · Hand the cashier the amount of cash you'd. At this time, you cannot use your Debit Card as a payment method in the Google Pay app to send money to friends and family. Google Pay when you add your Debit. How to add money with Apple Pay or Google Pay · From your 'Home' screen, tap 'Add money' · Set the currency to your card's local currency · Enter the deposit. To reset or confirm your default card, follow the steps below. Note: You'll need to install the Google Wallet app. 1. Open the Google Wallet app. 2. Tap Payment. How to add PayPal to Google Pay: Step-by-step · Open the Google Pay app · Tap your Profile picture and then Wallet · Tap Add to Wallet · Tap Payment card and then. To add your Cash App Card to Google Pay from the Cash App: Go to the Card tab on your Cash App home screen; Select Add to Google Pay; Follow the prompts. A faster, safer, easier way to pay. When you add your payment cards to Google Wallet, you can tap to pay anywhere Google Pay is accepted. And know your. Can a blocked phone contact send you money through googlepay? Same as Google Pay/Google Pay | Save to phone > Add to Google Wallet. Terminology. Open your N26 app and tap “Add money” · Select “Apple Pay” or “Google Pay” · Choose an amount · Follow the steps to confirm the payment · The money is available on. 2. All eligible Digital Wallets will display. Tap Google Pay. 3. All eligible cards will display. Tap the Add to G Pay. Open the Google Pay app on your device, go to “Add a payment method”, then snap a pic of your Capital One card or enter the details manually. About Cloud Billing accounts and Google payments profiles In Google Cloud, you can set up a self-serve, online Cloud Billing account and use it to define who. How Do I Pay with Google Pay? · Unlock your device (no need to open the app). · Hold the back of your device near a contactless payment terminal. · Your phone will. Add value or a pass in Google Wallet · Open the Google Wallet app · Tap your card, then find your SmarTrip · Tap "Add money or pass" · Choose to "Add money" or "Add. How to add your card to Google Pay · Open the Google Pay app on your phone. · Tap “Payment” and then “Add.” · Snap a pic of your card or enter the details manually.

Cost Of Full Adobe Suite

After the free trial expires, the student membership price is US$/mo for the first year, and US$/mo after that. How do I get a student discount. Adobe Creative Cloud All App Licenses Include: Photoshop, Illustrator, InDesign, Illustrator Draw, Adobe Stock, Typekit, Adobe XD, Dreamweaver. price for the creative cloud is $ a year. so let's say i end up using it for the rest of my life, 40 years or so. that's $27, Creative Suite Pricing for Commercial and Education. Adobe Creative Cloud All App Licenses Include: Photoshop, Illustrator, InDesign, Illustrator Draw, Adobe Stock, Typekit, Adobe XD, Dreamweaver. Individuals · US$/month subscription · Access 20+ Creative Cloud apps · Includes Photoshop, Illustrator, Premiere Pro, and more · (Substance 3D apps are not. Nowadays, where Adobe have changed from full license to subscription-based services, It is now around $ per month, or up to $ per year. Learn more about Adobe Creative Cloud pricing plans including starting price, free versions and trials. Creative Cloud All Apps is US$/mo — less than the cost of three apps at the regular price of US$/mo each. Watch the video. Free trial. After the free trial expires, the student membership price is US$/mo for the first year, and US$/mo after that. How do I get a student discount. Adobe Creative Cloud All App Licenses Include: Photoshop, Illustrator, InDesign, Illustrator Draw, Adobe Stock, Typekit, Adobe XD, Dreamweaver. price for the creative cloud is $ a year. so let's say i end up using it for the rest of my life, 40 years or so. that's $27, Creative Suite Pricing for Commercial and Education. Adobe Creative Cloud All App Licenses Include: Photoshop, Illustrator, InDesign, Illustrator Draw, Adobe Stock, Typekit, Adobe XD, Dreamweaver. Individuals · US$/month subscription · Access 20+ Creative Cloud apps · Includes Photoshop, Illustrator, Premiere Pro, and more · (Substance 3D apps are not. Nowadays, where Adobe have changed from full license to subscription-based services, It is now around $ per month, or up to $ per year. Learn more about Adobe Creative Cloud pricing plans including starting price, free versions and trials. Creative Cloud All Apps is US$/mo — less than the cost of three apps at the regular price of US$/mo each. Watch the video. Free trial.

Watch BEFORE You Buy The Adobe Creative Cloud Software! ⭐️ Richie It I try to renew, it wants me to pay full price. Wtf. 24 people found this. Monthly plan – $/month ($ per year). How to get the best price: First, it's best to decide what Adobe apps you need. If you need more than one app. You can also use Creative Cloud in the on-campus Tech Spot labs at no additional cost. The full Creative Cloud Suite (Photoshop, InDesign, Illustrator, etc.). Adobe Creative Cloud is only available as a full suite license. If you are looking to purchase two or more Adobe Apps separately, it is cost effective to. Adobe Creative Cloud offers individual app plans starting at US$/mo, the Creative Cloud Photography plan for US$/mo, and the Creative Cloud All Apps. You can also use Creative Cloud in the on-campus Tech Spot labs at no additional cost. The full Creative Cloud Suite (Photoshop, InDesign, Illustrator, etc.). Adobe Software · $50 - $ · $75 - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ Get 20+ Creative Cloud apps, including Photoshop, Lightroom, Premiere Pro and more. This is the full Adobe Creative Cloud experience at half the price. After you request this offer through TechSoup, you'll pay Adobe $ per month for the discounted membership. See the Details and Service Costs tab for more. I have the whole package and couldn't imagine not having it. AH. Allen H. Read the full review. *Pay US$/mo the first year and US$/mo after that. Regular standard price is US$/mo. Terms and Conditions Eligible students 13 and older and. Teams and businesses can subscribe to Creative Cloud at a rate of $/mo per license, with yearly plans billed either monthly or upfront at $1,/yr. Adobe Stock plans start at $29,99 per month, you can go here for all details on how much Adobe Stock costs. And you can also check our complete Adobe Stock. This membership is a discounted version of Adobe's Creative Cloud for teams membership and is available to all organization types that are eligible for Adobe. Adobe Creative Suite (CS) is a discontinued software suite of graphic design, video editing, and web development applications developed by Adobe Systems. Adobe applications require a subscription to use. These subscriptions range in cost between $5 and $55 per month. You could be looking to pay around $ a year. Seller: Adobe Inc. ; Size: MB ; Category: Productivity ; Compatibility. iPhone: Requires iOS or later. iPad: Requires iPadOS or later. iPod touch. The full Adobe Creative Cloud suite of apps is available to students Software license pricing is not prorated and includes required credit card fees. I have the entire Adobe Creative Cloud suite at a reduced monthly fee of $ a month (it's $ normally, but you can sometimes go to your. Adobe Creative Cloud is available at no cost to most faculty and staff and to some students. Students can purchase an Adobe Creative Cloud annual subscription.

What Does A Debt Consolidation Company Do

Most debt consolidation companies claim to be nonprofit, but they make a lot of revenue at the expense of their customers. By withholding payment, the debt settlement company attempts to make a lump-sum settlement offer more enticing to creditors. Note that your creditors will. When you apply for a debt consolidation loan, the lender will send the funds to your creditors to pay off those balances, so the only monthly payment you'll be. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Are you juggling several loan and credit card payments which carry high interest rates every month? Here's a way to save some money and make life easier. In debt consolidation, all your unsecured debts are added up and then you will be given a single monthly payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Combining debts into a single payment could make repayment easier, and you may be able to save money on interest. You can eliminate debts for less than what's. Most debt consolidation companies claim to be nonprofit, but they make a lot of revenue at the expense of their customers. By withholding payment, the debt settlement company attempts to make a lump-sum settlement offer more enticing to creditors. Note that your creditors will. When you apply for a debt consolidation loan, the lender will send the funds to your creditors to pay off those balances, so the only monthly payment you'll be. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Are you juggling several loan and credit card payments which carry high interest rates every month? Here's a way to save some money and make life easier. In debt consolidation, all your unsecured debts are added up and then you will be given a single monthly payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Combining debts into a single payment could make repayment easier, and you may be able to save money on interest. You can eliminate debts for less than what's.

If you are considering a debt consolidation loan, it makes sense to apply, or at least see your rate. If you are serious about getting out of a cycle of debt. You may be able to do this with a debt consolidation loan, balance transfer credit card or home equity loan. Debt consolidation can simplify your finances and. Debt consolidation allows you to make one payment to one lender every month rather than multiple payments to different lenders with various due dates. Saving on. Debt consolidation may be able to help lower your interest payments, your financial stress load and help you gain a more streamlined view of your finances. Sign-Up Process: Make a list of unsecured debts you would like to consolidate and add each balance (the total amount you owe) to find out how much. Debt consolidation is when an individual takes out a loan to pay off several different existing debts, eg loans, overdrafts or credit card borrowing. Consolidating could lower the cost of your debt or make it easier to manage (or both). gamedevmeet.ru How does debt consolidation work. A loan through Prosper is also one of your best options for debt consolidation because you will have personalized support on call. Prosper provides Customer. Debt consolidation is when you take out a loan and use it to pay off multiple debts which can simplify how many payments you have to make each month. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. Simplify your debt by consolidating multiple loans into one. Learn more about your options for consolidating to lower your monthly payments. With a debt consolidation loan, banks, credit unions or other types of lenders pay all your creditors or give you the money to pay them yourself. The new debt. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. In debt consolidation, all your unsecured debts are added up and then you will be given a single monthly payment. Debt consolidation involves taking out one loan or line of credit (ideally with a lower interest rate) and using it to pay off other debts. Debt consolidation occurs by taking multiple, high interest, unsecured debts and combining them into one. The advantage of the loan is lower interest rates and. Debt consolidation is promoted as offering people a positive way to reduce credit card debt, payday loans, and other debt and save money at the same time. Questions regarding bankruptcy cases filed in the six judicial districts in those states should be directed to the Bankruptcy Administrator for the district. Reduce the pressure. A debt consolidation loan lets you start fresh with Abound instead of answering to a variety of creditors. · Money-saving potential. Chances. You can do this by taking out a second mortgage or a home equity line of credit. Or, you might take out a personal debt consolidation loan from a bank or.